By Mark Wert, Catalyst Strategic Solutions, Senior Advisor

Not surprisingly, the pandemic has left its mark on the credit union industry. In short, credit unions have experienced a swift increase in assets in 2020 as members continue to grow their savings. As is the case with any recession, consumers generally look to save during uncertain times. To combat this slowdown in consumer spending – consumer spending is responsible for approximately 70 percent of economic growth – the Federal Reserve has undertaken unprecedented measures to stimulate the economy.

As a result of Fed actions in early 2020, interest rates declined significantly and remain near historic lows, and the Fed has pledged to maintain extraordinary support. Of course, that could change if the labor market miraculously reaches full employment and core inflation reaches and stays at or above the Fed’s two percent target. Mortgage rates have fallen to historic lows and have created a surge in purchase and refinance activity. In turn, credit union real estate loan growth is up, with first-lien, fixed-rate mortgages greater than 15 years on pace to increase $33.2 billion, or 19 percent, in 2020. Naturally, due to the duration of these assets, credit unions may be concerned about the potential interest rate risk (IRR) these mortgages create on the balance sheet.

With this background and the strong likelihood credit unions will continue to originate and take on more mortgages in 2020 and beyond, you may ask: How do we hedge against mortgage loan/portfolio IRR? How can we maintain a stable IRR profile and preserve interest income to protect the bottom line?

There are several ways to hedge embedded IRR in mortgages. Historically, the use of interest rate derivatives has been the most cost-effective approach. Catalyst Corporate can demonstrate how credit unions can use derivatives to protect income risk and maintain stable IRR profiles when adding mortgages to the balance sheet. Catalyst works with clients to help set desired risk parameters through various derivative strategies. We can also assist credit unions with the NCUA application process for IRR derivatives.

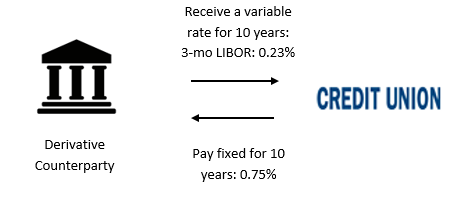

The next question becomes: How do financial institutions go about hedging mortgage IRR with derivatives, as well-documented mortgages generally extend when rates rise, while prepayments decline? In short, homeowners are less likely to refinance, as they lack the economic incentive to do so. The easiest way to hedge a portion of this risk is to enter a pay fixed-rate/receive variable-rate swap with a derivative counterparty. An interest rate swap is an agreement to exchange future payments of interest on a notional amount at specific times, for a specified term. By doing so, this type of swap will increase in value when rates rise, offsetting some of the market value decline in mortgages on the balance sheet. For example, a credit union can hedge a portion of their $1 billion real estate portfolio with a 10-year $50 million pay fixed swap.

You may wonder what notional amount your credit union should use and how long your swap should be. That comes down to your credit union’s risk appetite at the Asset-Liability Committee or management level.

The best way to evaluate the risk at hand is to run what-if rate shock scenarios on your loan portfolio. Then, re-run those scenarios by overlaying different hedges to help determine an acceptable risk outcome.

With rates already at historic lows, and close to zero, should we be concerned about future prepayment risk? While it is conceivable rates could go negative, although not likely for mortgages, prepayment risk can’t be ignored. Importantly, mortgage rates have a lot more room to decline relative to risk free rates and to a credit union’s cost of funds, thereby putting incremental margin at risk. Of course, you can sell the mortgage loans upon origination, but that will leave you with a smaller balance sheet, which may not be as scalable.

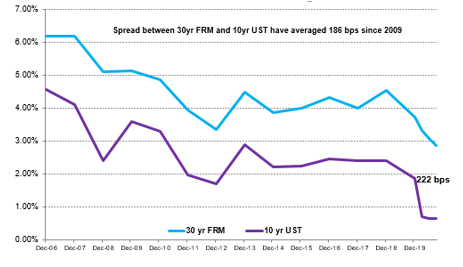

When lenders give homeowners the ability to prepay their loan early without penalty, prepayment risk is created. By using interest rate derivatives, you could buy options to offset the options you inherently sold when writing a new mortgage loan. For example, you can buy a three-year floor (a contract based on a reference interest rate for payment to the purchaser, when the reference interest rate falls below the level specified in the contract) on a 10-year Constant Maturity Treasury (CMT). Since 30-year mortgages track 10-year Treasuries (see chart below), 10-year CMT looks to be a solid option to use for hedging. So, if rates drop, the homeowner can prepay their mortgage, but you can offset some of that loss with the protection of the floor.

In summary, interest rate derivatives are a valuable, convenient, cost-efficient and flexible tool that can be customized to suit your hedging needs. Derivatives can also be used to hedge other items, besides mortgages, on your balance sheet. For example, you may want to lock in your deposit costs by paying fixed on an interest rate swap and receiving a money market index that best fits your historic deposit rates.

For further information on derivatives, or to see how hedging strategies may assist with your credit union’s IRR, contact us today.