By Justin Lutes, AAP, NCP, Vice President of Correspondent Services

Payments fraud has always been a concern, and reported incidents continue to rise. And now, even some of the traditionally lower-fraud payments channels are seeing an increase…such as ACH debit and ACH credit fraud.

Unfortunately, combating fraud has become an everyday occurrence for credit unions. And it’s not going to let up any time soon. In fact, payments fraud continues to increase every year, making it a top concern for payment services professionals nationwide.

According to the 2019 AFP Payments Fraud & Control Survey, a record 82 percent of organizations reported incidents in 2018. This is expected to continue growing, especially as fraudsters get smarter and payments get faster – both of which appear to have gained traction during the COVID-19 pandemic.

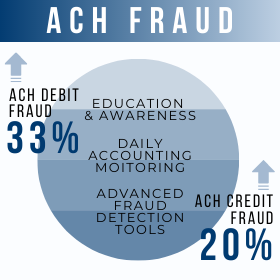

Study results also show that check fraud continues to lead in terms of attempted and/or actual payments fraud – tallying in at 70 percent – followed by wire transfers with 45 percent. ACH Debit fraud is next with 33 percent, and ACH Credit fraud with 20 percent.

Study results also show that check fraud continues to lead in terms of attempted and/or actual payments fraud – tallying in at 70 percent – followed by wire transfers with 45 percent. ACH Debit fraud is next with 33 percent, and ACH Credit fraud with 20 percent.

While historically lower than other payment methods, ACH fraud continues to increase. Furthermore, the study suggests this growing trend could be indicative of a more sophisticated type of payments fraud. As ACH fraud grows in both complexity and volume, so does the need for proper planning and prevention. So, where should credit unions start?

As with most security measures, a multi-layered approach is most effective. Finding the “right mix” of procedures, plans and tools will vary based on need, but there are three essential layers of ACH fraud prevention:

- Education and awareness

- Daily account monitoring

- Advanced fraud detection tools

Education and awareness

Staying ahead of today’s ACH fraud schemes means staying in the know. That’s why education serves as the base layer and cannot be stressed enough – both for credit union staff and members. Social engineering is big business, so it’s imperative that credit unions remain vigilant to help reduce the opportunities for falling victim to fraud. An effective way to establish awareness is through ongoing education. Ongoing employee education and training, paired with available tools and resources, can be extremely valuable.

Daily account monitoring

Daily account monitoring is the next layer, or mitigation tactic, that can help safeguard credit unions and members against fraudulent ACH transactions. It is extremely important to monitor accounts in order to act quickly on transactions that may be unauthorized or posted inadvertently. ACH has a built-in return process and it also has return timeframes, so the quicker you or your members identify these, the better.

Advanced fraud detection tools

Using an advanced fraud detection tool, like anomaly detection, within your credit union’s ACH origination system offers a third layer of protection. Anomaly detection can alert staff in real time to transactions that may be suspicious, further minimizing exposure to ACH fraud attempts. Now, more than ever, automated monitoring and instant notifications play a central role in stopping fraud before it starts. Catalyst Corporate’s ACHOne platform offers Anomaly Detection for ACH origination as an optional service module.

While the layers and preventative measures mentioned here are certainly not inclusive, they are a great start to protecting your credit union and your members.

As the battle against payments fraud wages on, remember you’re not in this alone. To learn more about Anomaly Detection, or the many other benefits Catalyst Corporate’s ACHOne platform has to offer, contact us today.