By Jeff Hamilton, Vice President of Member Credit

Recent conversations with credit unions and experience with 100+ loan participation pools indicate a growing interest among credit unions to buy loan participations composed of unsecured loans.

Before the pandemic era, interest in unsecured loan participations was minimal. However, in recent months, the Member Credit department at Catalyst Corporate has received increased inquiries from buyers looking for any type of loan participations, including unsecured loan portfolios.

Unsecured loan portfolios typically consist of higher-yielding assets based on the associated credit risk. For credit unions flush with cash in a low-rate environment, the search for higher yields is not surprising.

The chart below, compiled by S&P Global Market Intelligence, points out that unsecured personal loans are among the highest yielding loan assets available to credit unions. (Only unsecured credit cards produce more yield for credit unions.)

This burgeoning interest in pools of unsecured loans can also create an opportunity for credit unions looking to participate those loans and manage their own risk.

However, as with any loan participation, there are several factors for buyers to consider. Risk factors to evaluate include underwriting guidelines, note provisions, credit protection insurance, projected loan losses, servicing, membership requirements and loan origination source.

Indeed, one of the key considerations is the origination source. There are some important distinctions between direct unsecured loan pools versus indirect unsecured loan pools.

Let’s explore the differences:

Direct unsecured loans

When a credit union member is granted an unsecured loan (a direct unsecured loan), the strength of the relationship with the member supports payback. This comes from the expectation that the member will want to maintain good standing at the credit union.

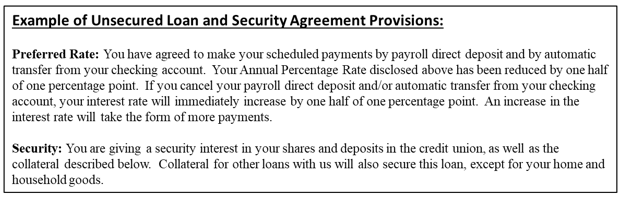

Beyond that good faith relationship, credit unions can add provisions to these unsecured loans that are tied to a variety of member benefits, such as rate reduction for direct deposit and automatic payments from the checking account. These promissory notes can also include a provision “securing” the unsecured loan with the member’s shares and deposits in the credit union (as well as other collateral, except home and household goods, for other loans).

See the sample agreement provisions below:

This direct member relationship is helpful when managing risk, as it can provide an additional level of security for the credit union. Both parties are likely to work toward a mutually beneficial resolution when issues arise. And failing that, with the extra measures of protection described above, a credit union can draw on the security interest in shares and other loan collateral for payment.

This direct member relationship is helpful when managing risk, as it can provide an additional level of security for the credit union. Both parties are likely to work toward a mutually beneficial resolution when issues arise. And failing that, with the extra measures of protection described above, a credit union can draw on the security interest in shares and other loan collateral for payment.

Indirect unsecured loans

As witnessed in the marketplace, many of the indirect unsecured loan participations are typically originated through an online channel by a fintech company and then funded by one of their lending partners, such as a bank or credit union. This arrangement is similar to the more familiar indirect auto lending programs; however, a notable difference is that there are no cars (i.e., collateral) providing underlying value.

Typically, in an indirect arrangement, the online originator (fintech company) is paid origination fees, and then net proceeds of the loan are wired to the borrower’s account. Generally, the fintech company services the loans, not the bank or credit union that is funding the loan.

So, when unsecured loan participation portfolios are originated through an indirect channel, there are a couple of additional points to consider.

It’s true that when a “lending partner” credit union funds the loan, it may gain a new member and secure that membership share deposit. But typically, there may be no further relationship between the borrower and the credit union, since the fintech company is servicing the loan. Without a meaningful relationship, and without the servicing, the credit union’s ability to manage the loan is negated and the credit union basically becomes a passive owner of the loan.

This ownership/servicing split arrangement creates a dynamic difference in the risk profile between the credit union and the servicer.

Principal losses are borne solely by the credit union and not the servicer. Yet, if there are any performance issues, the actions taken by the servicer will impact whether losses are realized.

So, it is important to understand the servicer’s focus. Are its activities primarily focused on collection, or to what extent will it work with borrowers to make modifications needed to reduce or prevent a loss?

Thus, for credit unions considering the purchase of a participation in a portfolio of indirect unsecured loans, the servicing policies and procedures are vitally important.

Conclusion

Different credit unions have different risk tolerances.

As with any loan participation purchase, comprehensive due diligence should review the loan originator, servicer, underwriting and performance history. Doing that should give purchasing credit unions a better perspective to determine if the risk/reward is acceptable. If the answer is “yes,” a loan participation built upon unsecured loans can be a great opportunity to add higher-earning assets to your credit union’s balance sheet.

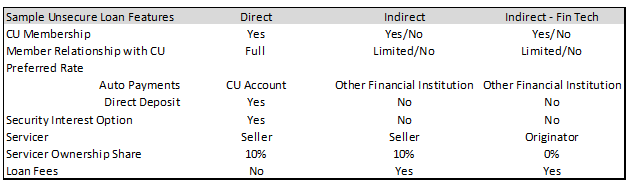

The chart below compares features of direct and indirect unsecured loan participations.

The Loan Participation program at Catalyst Corporate has facilitated more than $3 billion in credit union loans since 2014. LPExchange.org, or LPX, is a liquidity solution designed to help coordinate and execute transactions in a safe, secure and transparent platform.

The Loan Participation program at Catalyst Corporate has facilitated more than $3 billion in credit union loans since 2014. LPExchange.org, or LPX, is a liquidity solution designed to help coordinate and execute transactions in a safe, secure and transparent platform.

If your credit union is looking to sell a loan participation, let Catalyst Corporate’s experts connect you with a nationwide network of buyers representing all sizes of credit unions. For more information, contact us today.