By Jonathan Jackson, CFA, FRM Catalyst Strategic Solutions Senior Advisor

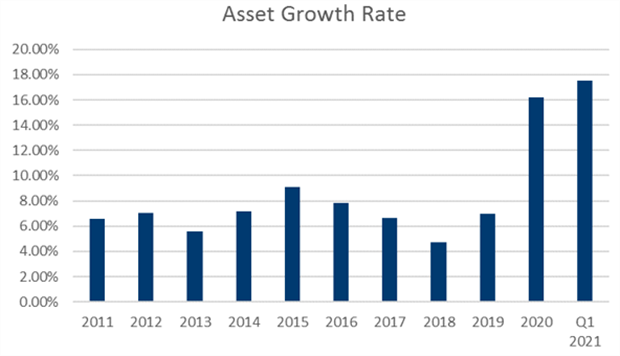

Want more insight? Register for the Mid-Year Economic UpdateCredit union asset growth remained strong in the first quarter. However, these days, describing asset growth as “strong” is an understatement. After increasing 16.2 percent in 2020, assets grew at an annualized rate of 17.5 percent in the first quarter of 2021.

Want more insight? Register for the Mid-Year Economic UpdateCredit union asset growth remained strong in the first quarter. However, these days, describing asset growth as “strong” is an understatement. After increasing 16.2 percent in 2020, assets grew at an annualized rate of 17.5 percent in the first quarter of 2021.

A consequence of this strong asset growth is the diluted capital ratios many are experiencing. The aggregate net worth ratio for all credit unions – 10.02 percent at the end of the first quarter – is 137 basis points lower than it was at the end of 2019. This asset growth is a direct result of the COVID-19 recession and immense monetary stimulus from the federal government. Although the recession is fading and the economy is reheating, excess deposits are unlikely to leave credit union balance sheets as quickly as they arrived.

A consequence of this strong asset growth is the diluted capital ratios many are experiencing. The aggregate net worth ratio for all credit unions – 10.02 percent at the end of the first quarter – is 137 basis points lower than it was at the end of 2019. This asset growth is a direct result of the COVID-19 recession and immense monetary stimulus from the federal government. Although the recession is fading and the economy is reheating, excess deposits are unlikely to leave credit union balance sheets as quickly as they arrived.

As a result, credit unions should be outlining and discussing potential strategies for rebuilding their capital position if the net worth ratio is below their optimal target level. Historically, this has been done by maximizing earnings and shrinking assets. However, one alternative strategy available to Low Income Designated (LID) credit unions is to issue secondary capital.

A LID credit union that is considering slowing loan growth and running off deposits to increase its capital ratios may be better served by incorporating secondary capital into its capital structure. By issuing secondary capital, the credit union could continue to serve its members and communities rather than be constrained by shrinking its balance sheet.

For example, take a credit union with $500 million in assets that has seen their net worth decline to 7.5 percent due to fast asset growth. Their target net worth ratio is 9.0 percent, given their asset allocation and risk tolerance. To increase their net worth ratio to 9.0 percent, assets would need to decline $83 million. Instead of reducing lending and financial services to members, the credit union could issue $7.5 million of secondary capital. By doing so, their net worth ratio would increase to 9.0 percent, enabling them to continue serving their members and communities.

When considering issuing secondary capital, keep in mind that the current secondary capital regulation will be replaced by a new subordinated debit rule in January 2022. Although subordinated debt will be used strategically the same way as secondary capital, a few key differences include:

-

In addition to LID credit unions, complex credit unions (assets of $500 million or greater) and new credit unions will be able to seek permission to issue subordinated debt.

-

LID credit unions will be able to include issued subordinated debt in the net worth and risk-based capital ratio calculations. Complex and new credit unions without a low-income designation will be able to include issued subordinated debt in the risk-based capital ratio calculation but not the net worth ratio.

- The new rule mandates a minimum maturity for subordinated debt of five years and a maximum maturity of 20 years.

-

A credit union is generally prohibited from being both an issuer and an investor in subordinated debt.

-

In addition to receiving approval from NCUA to issue subordinated debt, an issuing credit union will be required to meet federal and state securities laws, including providing required disclosures to potential investors in the offering documents and the subordinated debt promissory note. These legal requirements will likely require a credit union to work with securities law counsel and add costs.

The current secondary capital regulation remains in effect for the remainder of 2021. The subordinated debt rule takes effect January 1, 2022. Catalyst Strategic Solutions’ team of experienced Advisors stands ready to help you with this transition. If you’re ready to see how it could work at your credit union, book a meeting here. Or for more information on secondary capital, check out this helpful use case or contact us to learn more today.

Want more insight? Register for the Mid-Year Economic Update

Want more insight? Register for the Mid-Year Economic Update