By Zane Wilson, Vice President of Brokerage Services (Retired)

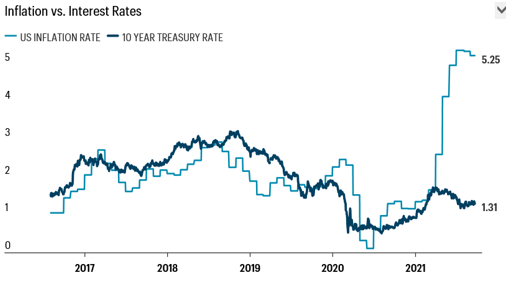

The most recent U.S. inflation figure reported for the last 12 months was 5.3 percent, the highest level in 13 years. Surprisingly, inflation has not been more than three percent since 2011.

Gross Domestic Product in second quarter 2021 came in at an annualized rate of 6.5 percent. The Federal Reserve is predicting the highest economic growth since the mid-1980s, around seven percent for 2021.

But, these numbers are coming off a low base from the pandemic slowdown. We should expect outliers in the data from the upside to the downside. With all the government spending, supply shortages, rising home prices, retail spending and higher inflation, you might assume this is the ideal environment for interest rates to increase

Treasury yields did rise recently, but have once again retreated, showing a clear divergence from the latest inflation numbers.

The question is why do bond investors willingly accept lower bond yields when projections abound for higher inflation and strong economic growth? This is common at this point in an economic cycle, if you want to call it a cycle. But there are a lot of factors influencing interest rate movement.

Current demographics

Nearly 10,000 Baby Boomers are expected to retire every day through the end of the decade, and it is common knowledge that this group controls the bulk of financial assets in this country, with close to $60 trillion in wealth. They don’t have much time to wait out down markets, and retirement generally means your portfolio goes from accumulating wealth to withdrawing for living expenses. For many, this would also mean reducing the risk of stocks and piling more into bonds.

In the last couple of decades, trillions of dollars have flowed into bond funds, even though yields have been low since the start of the Great Recession. If this trend continues, it could override macroeconomic factors and keep rates low, despite a strong economy.

The Federal Reserve’s role

Demand for bonds extends beyond the investor class. The Federal Reserve has been a large buyer of government bonds since well into the past decade, so Baby Boomers are only partly responsible for all the demand. Last year, the Federal Reserve and Treasury Department accounted for nearly 60 percent of U.S. government bond purchases. A majority of the purchases were driven by the pandemic, but the Federal Reserve and the U.S. government now own 25-30 percent of the country’s outstanding debt.

Traders are now wondering, “Will the Federal Reserve be able to sufficiently reduce its exposure to the debt markets in the next few years without blowing it up and causing rates to rise rapidly?” The recently proposed multi-trillion-dollar stimulus packages will add to this concern and certainly make it more difficult for the Federal Reserve to unwind their positions.

To manage this risk, it’s likely the Federal Reserve will be forced to continue playing a large role as a holder of government debt to keep borrowing costs under control. This means more future bond purchases by the Federal Reserve, and just like the shift in consumer patterns (due to retiring Boomers), further upward pressure on bond prices and downward pressure on yields.

Other reasons why interest rates are not higher

Other macroeconomic reasons may explain why interest rates aren't rising as many expected.

The U.S. has the largest, most diverse, most mature economy and financial markets on the planet…and a strong currency.

The stability and health of a nation have a lot to do with the level of long-term rates for its debt. Interest rates are higher when economies are unstable and fall, over time, as countries mature. As countries become wealthier, their borrowing costs typically decline.

Some may make the point that interest rates paid to investors should not be high when a strong nation is guaranteeing return of principal and interest. The 10-year Treasury yield has not been over four percent since 2008 and only barely topped five percent in 2007. Maybe the days of 5-6 percent Treasury yields are behind us due to the combination of a more mature economy, higher levels of generational wealth, continued technological innovation, and more importantly, increased Treasury holdings by other global central banks.

A U.S. Treasury bond is known as a risk-free investment and viewed as the biggest safe haven for investors when economic turmoil surfaces around the world. Why should these investors earn a high rate? Interest rates are hard to predict; the last 18 months have been an example of that. Who could have foreseen such low rates for an extended period of time? But credit unions and investors around the globe should be ready in case interest rates continue to stay relatively low for the next decade.

Catalyst Corporate’s Brokerage Team offers a wealth of knowledge and experience to help your credit union prepare for varied interest rate environments. To find out how they can help you plan for the road ahead, contact us today.

All securities are offered through CU Investment Solutions, LLC. The home office is located at 8500 W 110th St, Suite 650, Overland Park, KS 66210. CU Investment Solutions, LLC registered with the Securities and Exchange Commission (SEC) as a broker-dealer under the Securities Exchange Act of 1934. CU Investment Solutions, LLC is registered in the state of Kansas as an investment advisor. Member of FINRA and SIPC. All investments carry risk; please speak with your representative to gain a full understanding of said risks. Securities offered are not insured by the FDIC or NCUSIF and may lose value. All opinions, prices and yields are subject to change without notice.