By Paul Shorkey, CFA, FRM, Catalyst Strategic Solutions ALM Consultant

Over the second quarter of 2022, interest rate risk has seen pronounced movement, with many credit unions concerned about the impact on the NEV Supervisory Test. This can be attributed to the Federal Reserve aggressively raising rates at a pace not seen since the early 1980s, as recent inflation data has forced their hand. The 0.75% increase in the Fed Funds Target Rate at the June Federal Open Market Committee meeting, due to a hot CPI print, came to the markets somewhat unexpectedly (another followed in July).

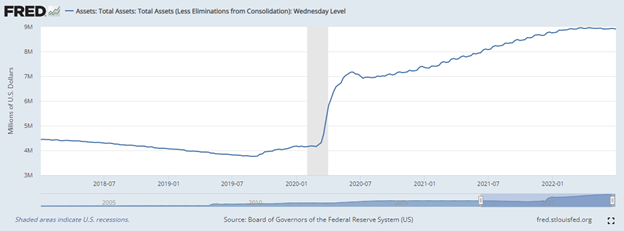

Additionally, the Fed is attempting to unwind some of its $8.9 billion balance sheet in the form of an increased supply of U.S. Treasury bills and notes that must be absorbed by the overall market. Fighting inflation and tightening liquidity will be a burden for credit unions attempting to manage their operating margin while adding value for members.

Managing the extraordinary surge in member deposits that occurred from pandemic stimulus is an area of concern. Many credit unions are seeing these balances decline rapidly as higher costs absorb this liquidity. The scenario potentially leaves more rate-sensitive members with balances searching for higher earnings as risk-free U.S. Treasury rates become more attractive. Credit unions can finally respond to this challenge, deploying these deposits in better investment and loan rates.

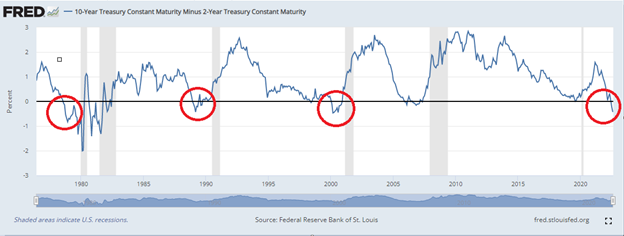

The existing “hyper” rate cycle pressures interest rate risk measures and creates potential credit risk problems. The temptation to load up on consumer credit to fund increased saving and borrowing costs is a serious risk. The large yield curve inversion that has developed is a reliable indicator of economic slowdown and potential credit problems. An inversion of this magnitude and swiftness has not occurred since before the financial crisis: the dot-com bubble, the late 80s, and earlier.

Despite this somewhat gloomy prospect, the current challenges may promote more attractive opportunities for credit unions, especially those without high operating margins. Moving forward, strategies to consider include: focusing on solid credit borrowers, maintaining a high-grade investment ladder, and raising deposit rates slowly and incrementally, staying ahead of competitors.

Although an opportunity to improve margin rapidly, consumer credit and credit card balances for members with low credit scores should be managed conservatively in the current environment. A balanced investment ladder that mimics the duration of deposits is a viable strategy and can be used as a liquidity backup. Finally, targeted CD specials, selective borrowing, and careful rate-sensitive share pricing can maintain a cost of funds to sustain a better net interest margin.

Our comprehensive ALM service offering can accommodate your modeling needs, as well as provide professional advice around these assumptions. For more information, contact us today.