by

Catalyst Corporate | Oct 25, 2022

Inflation remains high and the Federal Reserve remains on its mission to tame it. After increasing the key overnight rate five times this year, the Federal Reserve has brought the benchmark rate to the 3.00-3.25% range. Unfortunately, even after 300 basis points of tightening, GDP declined 0.6% in the second quarter after falling 1.6% in the first quarter. Despite economists debating whether we are in a recession or not, it does “feel” we are indeed more likely to be in one sooner than later.

What does all this mean for credit unions?

Credit unions should consider several factors when evaluating the current economic backdrop. Inflation continues to remain near historically high levels despite the substantial rise in interest rates over the past seven months. Supply chain disruptions have improved in some areas of the economy but the fighting between Russia and Ukraine has created additional global energy and food shortages, intensifying inflation pressures around the world.

Federal Reserve Chair Jerome Powell’s message has been loud and clear – the Fed will not stop raising interest rates until it is confident inflation is headed toward 2%. Recent comments from Fed officials suggest the target Fed funds rate could reach 4.50% by year end before reaching a peak of 5% in 2023. The Federal Reserve believes the current 2.25-2.50% range is the neutral Fed funds rate (a rate that is neither restrictive nor accommodative). This means the Federal Reserve intends to move the Fed funds rate into a restrictive stance, even though the economy is either in, or nearing a recession.

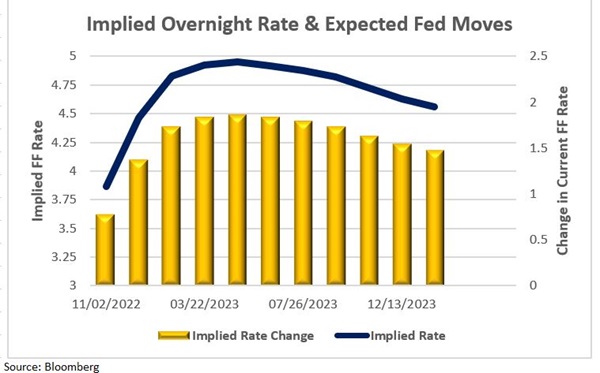

Considering the above, it would be fair to assume the Federal Reserve will increase the Fed funds rate by 75 basis points at the November FOMC meeting, followed by a 50- or 75-basis-point increase in December. The graph below illustrates the general market is expecting the Fed funds target rate to peak in December 2022 and to start declining after the first quarter of 2023.

This means credit unions are beginning to see the light at the end of the tunnel. Short-term rate increases should come to an end in early 2023. However, the Fed is expected to leave rates at the peak level for some time to allow the economy to feel the full effect of higher rates.

How should credit unions navigate this rapidly evolving environment?

First, consider that interest rates are likely near their peak. This is highlighted by the recent changes in the Treasury market as it repositions itself in advance of the Federal Reserve’s aggressive interest rate policy. Even as the 10-year U.S. Treasury rate has increased 55 basis points over the last month, the difference between the 2-year and the 10-year Treasury notes has become more deeply inverted at minus 25 basis points. If interest rates are near their peak, it may be time to consider adding duration (maturity) to your balance sheet.

From a management or strategy perspective, credit unions could benefit from locking in yield and duration to support net interest income in the future. However, with mortgage volume slowing because of mortgage rates approaching 7%, executing this strategy is becoming more difficult. Further, most credit unions are under heavy pressure with high risk classifications on their NEV Supervisory Tests. But mortgage volume is not the only option for adding duration. Credit unions can also consider opportunities within the securities markets and commercial lending. Keep in mind if we are in the early stages of a recession, tighter underwriting criteria becomes more important.

On the deposit side, many credit unions are seeking strategies to return value to their membership. This often requires credit unions to choose between raising non-maturity deposits and offering term deposit specials. The relative impact of an increase in non-maturity deposit rates can be significant, as the entire balance reprices higher immediately. With the prospect of a recession and potential for increased credit losses in the future, credit unions are encouraged to protect their margins and maintain sound capital growth. As a result, consider offering term deposit specials that can be matched off against a “like-term” investment alternative for a healthy spread. Many such opportunities exist along the yield curve that can provide value to your membership without jeopardizing the safety of your credit union.

If you decide an increase in non-maturity deposits is the best path, consider making increases in dividend rates commensurate with increases in average loan rates. Credit unions pride themselves on having the lowest loan rates, but this can still be achieved after raising rates. We are in a different interest rate environment than we were five years ago and now is the time to make the necessary adjustment to protect your balance sheet. “Pegging” dividend rate increases to loan yield increases helps absorb the bulk of interest expense increases through interest income, which helps maintain and protect your margin.

In summary, we are nearing an inflection point in the economy, where we transition from a rising rate to a falling rate environment. Credit unions should begin adjusting their strategies and repositioning asset allocation to support a wider net interest margin. This will help build net worth as interest rates begin to move back down. Yes, there is pressure to raise dividend rates. However, this can be accomplished strategically in a way that provides value to your membership without eroding net worth contributions. On the asset side, it is time to find ways to add duration (maturity) to the balance sheet and lock in attractive market rates; they probably will not be around for long.

At Catalyst, our goal is to help credit unions safely and successfully navigate through challenging times. If you need assistance, our team of seasoned professionals is available to assist you with all aspects of your balance sheet – from investments, liquidity management, portfolio management to risk management, derivative hedging, and subordinated debt. For more information, contact us today.