2023 Member Insights Survey

Summary

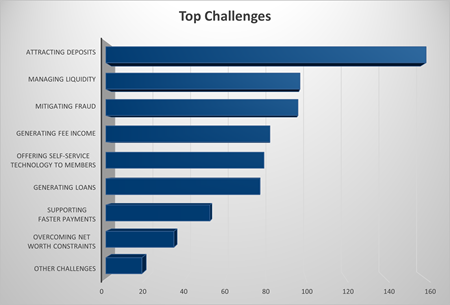

'Attracting Deposits' Rated Credit Unions' Leading Challenge in 2023 Survey

In late July, Catalyst Corporate distributed the Member Insights Survey (MIS) to 4,824 credit union C-suite executives and operations contacts. The purpose of the survey was to determine recipients' key strategic initiatives and objectives, top challenges, aspects of Catalyst that bring them the greatest value and how Catalyst can help meet their needs.

When asked “From your perspective, what are your credit union’s top challenges,” responses to the options provided were:

- Attracting deposits (160)

- Managing liquidity (97)

- Mitigating fraud (96)

- Generating fee income (82)

- Offering self-service technologies

- Generating loans

- Supporting faster payments

- Overcoming net worth constraints

- Other challenges

This year's results represent a true sign of the times with "Attracting deposits" and "Managing liquidity" cementing the top two spots. Interestingly, "Attracting deposits" scored nearly double last year's top response, which was "Generating fee income." New to the survey and coming in third place was "Mitigating fraud."

“New concerns reflect the fast-changing financial environment credit unions now face,” said Mike McGinnis, Catalyst's chief investment officer. "The current economy's impact on credit union liquidity is obvious with a reorder of the top three challenges.”

"An increase in the importance placed on attracting deposits indicates credit unions are feeling the effects of tight liquidity," McGinnis said. "The higher priority placed on mitigating fraud shows credit unions are carefully attuned to battling additional losses of income."

Another section of the survey gave credit unions an opportunity to evaluate their partnership with Catalyst and Catalyst's assistance in meeting their needs. A total of 261 responses were received in this area, with 95.7% of respondents saying Catalyst meets their needs well or very well.

Catalyst strives to offer a portfolio of products and services credit unions can use to meet their members' needs. The organization also supports credit union service users "beyond the sale" with its experienced team of experts.

For additional credit union insights, see results of Catalyst’s 2023 Net Promoter Score survey.