by

Catalyst Corporate | Jan 25, 2023

Liquidity conditions are a pendulum swing of challenges for many credit unions. Prior to 2022, credit unions had ample liquidity due to inflow of funds, and liquidity management mostly involved getting the funds deployed to earn a positive return.

In 2022, the pendulum swung back, and credit union managers faced the opposite challenge of having to keep and raise funds to maintain sufficient liquidity for their credit union. In our previous article, we touched on three options for increasing liquidity: borrowing, selling securities and selling loan participations. In this follow-up, we will take a deeper dive into the impact of each alternative.![]()

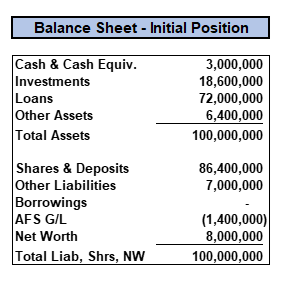

For purposes of our analysis, we will use a representative $100 million credit union that has been experiencing robust loan demand and is in a tight liquidity situation. Loan demand has driven the loan-to-share ratio up to 83%, while the on-balance-sheet liquidity, Cash & Cash Equivalents, has dropped to 3% of total assets as shown here in the summary balance sheet.

As a starting point, our credit union has strong earnings posting a 1% return on assets (ROA) and is well capitalized with a net worth ratio of 8%. However, as with many other credit unions, the rise in interest rates has depressed the value of investment holdings for our sample credit union.

We’ll assess the impact of raising liquidity on each of the measures below.

Options for Managing a Tight Liquidity Situation

The same options are available to all credit unions, and they all have some form of cost. A complicating factor in deciding is the rise in interest rates in 2022, which has left credit union investment portfolios and loan portfolios with underwater valuations. There is no question that incurring losses is undesirable, yet losses can be realized explicitly or implicitly. Selling investments or loans at less than cost is a directly recognizable loss (explicit loss), whereas retaining loans or investments that earn below-market rates is an interest “loss” that is realized over time as lower income (implicit loss). These factors influence the pros and cons of each option, with the impact varying from one credit union to another. Let’s look at each in turn.

Borrowings/Non-Member Deposits

Borrowing and/or raising non-member deposits are probably the most common and frequently used methods for accessing liquidity. Every credit union has a line of credit or other borrowing arrangement set up with their corporate credit union, the Federal Home Loan Bank, the Federal Reserve or other institution. Tapping into one of these arrangements provides virtually immediate balance sheet liquidity, the main advantage of borrowing through any of these sources. On the other hand, borrowing can be expensive.

Another route credit unions pursue for liquidity is raising money through non-member deposits. This tool saw increased usage in 2022, as liquidity grew tighter over the past several months; however, depending on the amount of funding a credit union needs, this avenue may take time to reach the desired level, as most funds are raised in individual amounts of $250,000 or less. Although not as quick as borrowing from a line of credit, the funding cost for non-member deposits may have an advantage over borrowing, depending on the term.

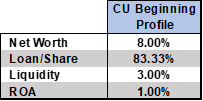

Taking on borrowings and non-member deposits as the means of increasing liquidity inflates the size of your balance sheet and affects several important credit union measures. To see this impact, our $100 million sample credit union is going to borrow $10 million at a rate of 5.25%. The impact of borrowing is shown below in the before and after position of the credit union. ![]()

![]() The proceeds from the loan have bolstered the credit union’s cash position and improved the liquidity situation. As shown below, the liquidity position has improved to 11.82%, up from 3% of assets; however, this liquidity has come at a “cost.” The additional interest cost on the loan is only partially offset by earnings on the cash position, resulting in lower net income, causing ROA to drop to .55% from 1%. Also, the credit union’s loan-to-share ratio remains unchanged, while the borrowing has inflated the size of the balance sheet, driving the net worth ratio down from 8% to 7.27%.

The proceeds from the loan have bolstered the credit union’s cash position and improved the liquidity situation. As shown below, the liquidity position has improved to 11.82%, up from 3% of assets; however, this liquidity has come at a “cost.” The additional interest cost on the loan is only partially offset by earnings on the cash position, resulting in lower net income, causing ROA to drop to .55% from 1%. Also, the credit union’s loan-to-share ratio remains unchanged, while the borrowing has inflated the size of the balance sheet, driving the net worth ratio down from 8% to 7.27%.

Lines of credit and borrowing arrangements are probably the easiest tools credit union managers have to bring liquidity onto the balance sheet. Despite their ease of use, the broader impact on the credit union should be considered to ensure performance or capitalization doesn’t breach critical threshold levels.

Lines of credit and borrowing arrangements are probably the easiest tools credit union managers have to bring liquidity onto the balance sheet. Despite their ease of use, the broader impact on the credit union should be considered to ensure performance or capitalization doesn’t breach critical threshold levels.

Selling Securities

Investment portfolios are important components of credit union balance sheets. Individual securities can be pledged as collateral for lines of credit, and the interest income they generate provides an important source of earnings. Most importantly, investment portfolios serve as a liquidity reserve that credit unions can turn to when liquidity is needed. Unfortunately, the rising rates in 2022 have credit unions sitting on portfolios that may be significantly under water, and since selling securities would result in booking a loss, most credit unions have ruled out this option altogether.

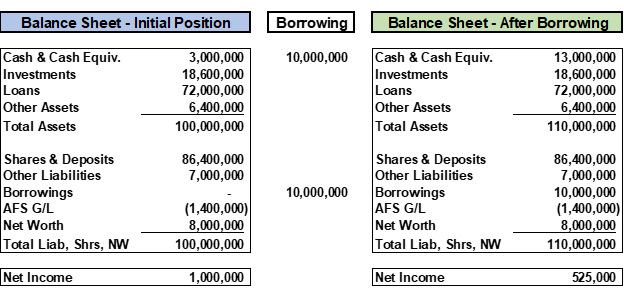

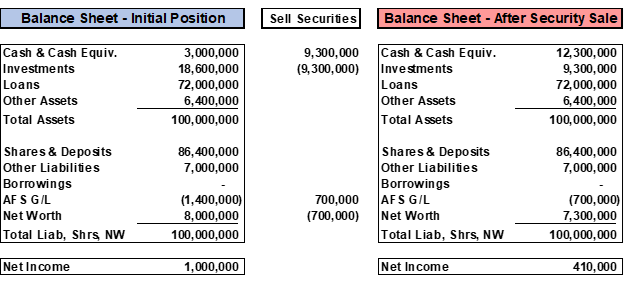

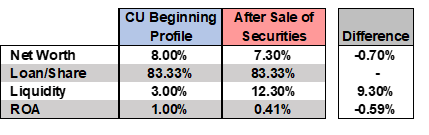

Although losses are undesirable, selling securities should not be ruled out as an option simply because a loss would occur on the sale. A more comprehensive evaluation, where the loss is just part of the “cost” of raising liquidity, should be considered. Selling securities as a means of increasing liquidity does not inflate the size of your balance sheet like borrowing does. To see this impact, our $100 million sample credit union is going to sell $10 million par value of securities that are under water at a price of $93. The impact of this transaction is shown below.

![]() The proceeds have bolstered the credit union’s cash position, improving liquidity to 12.3% of assets, up from 3%, while the sale of securities has not inflated the size of the balance sheet compared to the borrowing. The “cost” of this liquidity comes in the form of the $700,000 “realized” loss. The market value depreciation of the securities is already reflected in the AFS Gain/(Loss) account, and when the securities are sold, the loss

The proceeds have bolstered the credit union’s cash position, improving liquidity to 12.3% of assets, up from 3%, while the sale of securities has not inflated the size of the balance sheet compared to the borrowing. The “cost” of this liquidity comes in the form of the $700,000 “realized” loss. The market value depreciation of the securities is already reflected in the AFS Gain/(Loss) account, and when the securities are sold, the loss becomes realized and is reflected in the capital accounts, resulting in the net worth ratio declining to 7.30% from 8.00%. Similar to the borrowing option, the credit union’s loan-to-share ratio remains unchanged by selling securities. However, the income impact has dropped ROA 59 basis points to 0.41% from 1%.

becomes realized and is reflected in the capital accounts, resulting in the net worth ratio declining to 7.30% from 8.00%. Similar to the borrowing option, the credit union’s loan-to-share ratio remains unchanged by selling securities. However, the income impact has dropped ROA 59 basis points to 0.41% from 1%.

Selling Loans / Loan Participations

Credit union loan participations have experienced an explosion in activity the past few years. As activity has grown, credit unions of all sizes have become more familiar and more involved – to the point that loan participations have become a widely accepted tool for both buyers and sellers. For buyers, they are attractive income-producing assets. For sellers, loan sales have become an important source of liquidity, enabling sellers to maintain origination activity. Sellers often booked gains from sales, that is, until the rate rise in 2022 pushed loan portfolio valuations to losses.

In the same vein as with underwater security portfolios, a loan participation portfolio valuation that would result in a loss on the sale is often immediately dismissed as not viable. Again, no one wants to book a loss, but by summarily dismissing the alternative, you may be ignoring a less costly strategy for generating liquidity.

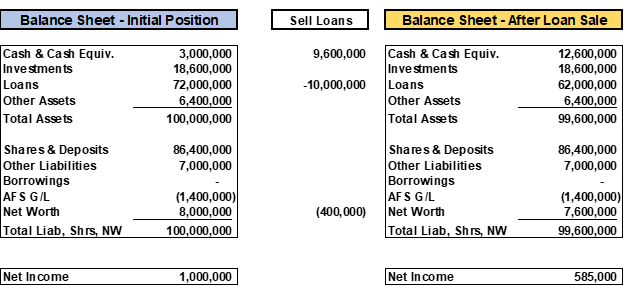

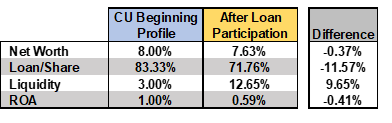

Since accounting rules require sellers to retain an ownership interest in loan participation portfolios, typically 90% of the loans are sold. The 10% unsold portion remains on the sellers’ balance sheet. To see the impact of a loan sale, since 10% remains on the balance sheet, the $10 million pool of loans in our example represents the 90% portion of the loan participation. Given the current level of interest rates, the loans are underwater, valued at a price of $96. The impact of this transaction is shown below.

![]()

![]() Once again, this credit union has bolstered its liquidity position by selling loans. Cash & Cash Equivalents have risen to 12.65% of assets after the sale, and the loan-to-share ratio has dropped to approximately 71% from 83%. This reduction in the loan-to-share

Once again, this credit union has bolstered its liquidity position by selling loans. Cash & Cash Equivalents have risen to 12.65% of assets after the sale, and the loan-to-share ratio has dropped to approximately 71% from 83%. This reduction in the loan-to-share  ratio may also provide ancillary benefits by relieving pressure on concentration limits or other policy requirements. On the flip side, the cost of this strategy is reflected in the capital account, resulting in a slightly smaller balance sheet by the amount of the loss on the sale. This impact has resulted in a 37-basis-point drop in net worth to 7.63% and a 41-basis-point drop in ROA to 0.59%.

ratio may also provide ancillary benefits by relieving pressure on concentration limits or other policy requirements. On the flip side, the cost of this strategy is reflected in the capital account, resulting in a slightly smaller balance sheet by the amount of the loss on the sale. This impact has resulted in a 37-basis-point drop in net worth to 7.63% and a 41-basis-point drop in ROA to 0.59%.

Comparing the Alternative Strategies

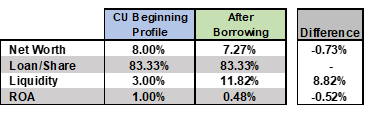

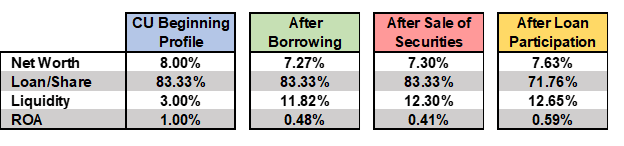

Determining the “right” path for your credit union is sometimes difficult. As laid out above, each option for increasing liquidity has a cost associated with it. Each of our three scenarios has affected the credit union in different ways. By lining up the results, we can see how the strategies impact the four measures we set out to assess.

Net Worth: Selling loan participations gave the credit union the highest net worth ratio. Though the loan participation strategy shrank the balance sheet slightly, the borrowing strategy depressed the net worth ratio to a greater degree by ballooning the balance sheet. The sale of securities didn’t impact the balance sheet size but resulted in the largest change to net worth.

Net Worth: Selling loan participations gave the credit union the highest net worth ratio. Though the loan participation strategy shrank the balance sheet slightly, the borrowing strategy depressed the net worth ratio to a greater degree by ballooning the balance sheet. The sale of securities didn’t impact the balance sheet size but resulted in the largest change to net worth.

Loan/Share: Neither borrowing nor selling securities impacted the loan-to-share ratio. Only the loan participation strategy brought down the ratio, while possibly resulting in additional benefits of relief in concentration levels or other limits.

Liquidity: All three strategies achieved the objective of improving the credit union’s liquidity situation. The loan participation strategy resulted in the highest level of liquidity measured in percentage of assets. The borrowing strategy, even though it resulted in the lowest percentage of liquidity, resulted in the highest actual dollar amount of liquidity.

ROA: Increased interest expenses and realized losses weighed heavily on ROA in each scenario. A direct reflection of the “cost of liquidity,” the magnitude of the loss on the securities was the highest cost with the lowest ROA. The loan participation sale had the least “cost” of the three scenarios and the highest ROA.

Overall, the loan participation strategy came out on top in these scenarios, positioning the credit union with the highest net worth ratio, liquidity, ROA and an improved loan-to-share position.

Every credit union has access to the same set of tools, but individual circumstances may dictate which tool is right for the moment. By considering your options and applying a cost/benefit approach, one option should rise above the others.

Solving Current Liquidity Challenges

If you believe we are heading into a recession in 2023, it would be prudent to maintain strong access to secondary liquidity sources (i.e., borrowings). The sale of securities could impact borrowing capacity with partners if they are used as collateral. The same is true for certain loan products that could be sold as loan participations (i.e., real estate loans).

While selling a security or loan participation at a loss may not be desirable, it may be your best (and cheapest) option and ensure sufficient access to liquidity in the future should the need arise.

If you are on the fence about selling a loan participation, issuing non-member deposits or taking on borrowings, Catalyst Corporate would be happy to discuss the pros and cons and help guide you to the lowest total cost option. At times, it may be securities. At others, it may be a loan participation sale or external funds. Contact us so we can help inform in making the best decision for your credit union.