By Casey Peterson, Catalyst Strategic Solutions Senior Advisor

As of mid-2021, credit unions had experienced roughly 18 months of share growth offset by slow lending. Lower gross asset yields, due to sluggish loan activity, and a prolonged low interest rate environment add up to downward pressure on credit union net worth and net interest margins.

The current outlook on short-term interest rates is that they’ll likely remain low for an extended period, while loan portfolio growth is expected to slowly improve.

So, what does that mean for the now? Given this environment, credit unions should proactively modify their cost of funds to enhance current margins and prepare for future returns.

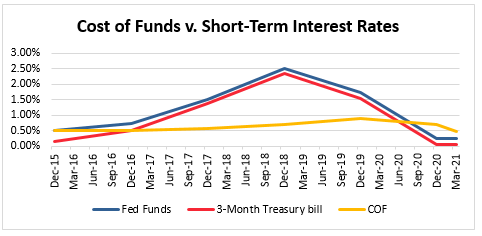

The Federal Reserve has indicated its intent to approach raising the benchmark Fed Funds rate cautiously. Currently, the range is 0.00-0.25 percent, with the next increase projected for sometime in 2023. This means credit unions will continue to earn overnight and short-term returns of about 10 basis points (bps) or less on cash and equivalents. The commonly used three-month Treasury bill is yielding 0.04 percent (as seen below). Comparatively, the average cost of funds through the first quarter of 2021 is 0.48 percent.

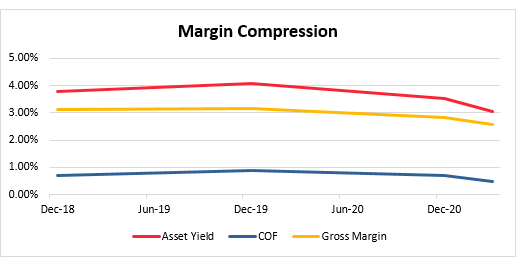

Since year-end 2019, asset yields have moved from 4.07 percent to 3.05 percent at the end of first quarter 2021. Cost of funds moved from 0.90 percent to 0.48 percent for the same period. Overall asset yields have decreased 102 bps, while cost of funds is only down 32 bps. Gross margins also decreased from 3.17 percent at year-end 2019 to 2.57 percent at the end of the first quarter – a 60 bps drop.

With minimal expectations of a rate hike any time soon, it will be difficult to improve asset yields in the near term. One strategic short-term option is to continue reducing interest expense to help maintain, if not improve, gross margins. To do so, credit unions should start by examining non-term and term share rates to validate the liquidity needed for additional deposits at a premium cost.

In summary, credit union share growth continues to outpace equity growth, thus maintaining downward pressure on net worth ratios. Lowering deposit rates may not slow deposit growth, but it will provide an opportunity to improve margins. The sooner a credit union can reduce interest expense and take advantage of the additional liquidity, the longer a credit union will reap the earnings benefit.

Catalyst Strategic Solutions’ team of experienced Advisors has the skills and know-how to help your credit union build an effective short-term strategy for the road ahead. For more information, contact us today!