Paul Shorkey, CFA, FRM, Catalyst Strategic Solutions ALM Consultant

With the Federal Reserve signaling to markets that inflation fighting – rather than a focus on full employment – is the imminent mandate, the specter of rising interest rates now looms. High CPI numbers have caused this shift. But is the inflation threat real, given the supply chain effects of the pandemic and long-term rates that remain at levels well below the prior rate cycle?

The credit union industry’s biggest challenge on the Asset Liability/Management (ALM) front is going to be whether to plan for a rise in rates considering the most recent interest rate cycles.

When it comes to ALM, Non-Maturity Deposit (NMD) modeling will always be the biggest bogey for credit unions. With savings, checking and money market balances representing the largest portion of the right side of the balance sheet, the assumptions around a credit union’s NMDs are the key to interest rate risk modeling.

The three key assumptions for modeling these instruments should be in the following order:

- Share beta – the rate at which the credit union raises/lowers the dividend rate as correlated with the change in a market index (usually, the Fed Funds target rate)

- Decay rate – the rate at which balances fall as an account matures

- Final maturity – the length of time an account stays open

As important as these assumptions are, there are nuances in modeling and periodic sensitivity tests to consider for each assumption. For instance, share betas are often considered in light of keeping balance decay constant, given the change in market rates.

Regarding decay, some accounts may see an actual increase in balances, but generally with the law of large numbers, at least some trickle of outflow from these accounts will occur. Lastly, the final maturity assumptions may have to be conservative, even though account attrition is minimal, as this age will ultimately determine the value of all current balances.

Please note, it is always prudent to also run a sensitivity test using the

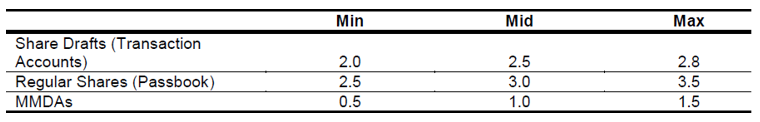

National Economic Research Associates’ (NERA) Non-Maturity Deposit Study numbers to check your NMD assumptions. Although not officially adopted by examiners, this study, conducted for the NCUA in 2001, provides conservative guidance on the modeling of NMDs. The output from this study assigns a duration to each of the share accounts (see figure below).

A combination of the above-mentioned factors can be used to proxy these durations and accommodate the NERA study.

Catalyst Strategic Solutions’ ALM Team is here to help guide you in your modeling of these instruments. Our comprehensive ALM service offering can accommodate your modeling needs, as well as provide professional advice around these assumptions and add sensitivity analysis.

Additionally, Catalyst’s experts can perform a deposit study to review your deposit history, along with industry data, and provide an NMD analysis that captures the unique behavior of your membership. For more information, contact us today.