By Al Schiliro, Senior Investment Officer

Bonds can help transform your portfolio, but some bonds will outperform others in a rising rate environment. Many credit union investors are still flush with cash and making their first bond purchases. Others, who previously have only purchased new issue bonds at par value, callables or mortgage-backed securities (MBS), are adding non-callable bonds (bullet maturities), predominantly U.S. Treasury bonds. Many investors tend to lean toward bonds that trade below par value ($100), known as discount bonds, and shy away from bonds trading above par, known as premium bonds. Choosing a lower coupon bond over an above-market coupon bond may not always be the best strategy.

Let’s look at one comparison. The results may surprise you.

Both the lower coupon and the above-market coupon have maturities of January 2026. The analysis for the lower coupon shows the yield does not always reflect the absolute value of a bond. The above-market coupon in this illustration will provide the credit union with elevated interest income as well as greater total income.

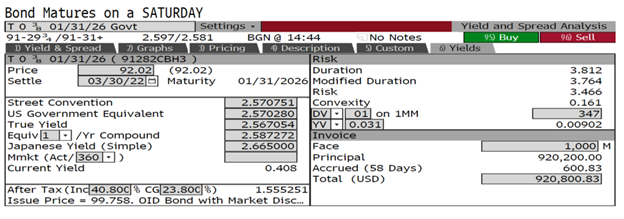

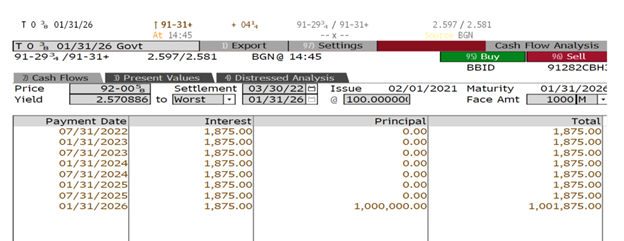

LOWER COUPON

UST 0.375%, 1/31/2026, Current Price 92.02, Current YTM 2.57%

Interest Income: $1,875 x 8 payments = $15,000

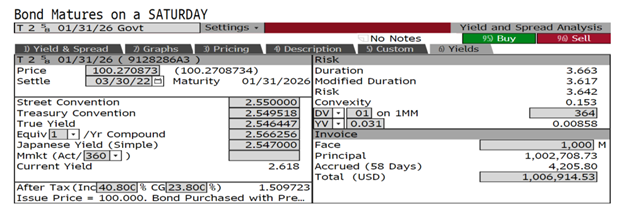

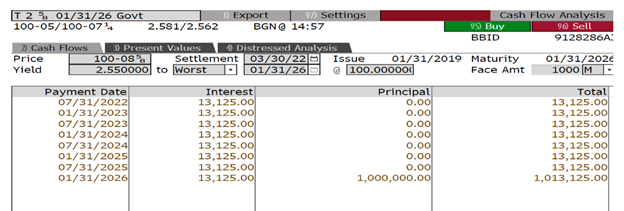

ABOVE-MARKET COUPON

UST 2.625%, 1/31/2026. Current Price $100.271, Current Yield to Maturity 2.55%

Interest Income = $13,125 x 8 payments = $105,000

The discount bond is purchased at a lower price than face amount. The difference between the purchase amount and maturity amount is then calculated into the yield. Yield is inversely correlated with price. If one goes up, the other comes down. Interest income is based on the coupon. Regardless of the purchase price, coupons remain the same.

The cash flow is skewed to the back end – in this example, four years. Instead of breaking out the premium from the accrual on the premium bond, total cost was used for both calculations to simplify the comparison.

Discount bond: Interest income equals $15,000 and the difference between $1,000,000 and total cost of $920,826.84 = $79,173 + $15,000 = $94,173 total income

Premium bond: Interest income equals $105,000 and the difference between $105,000 and premium (with accrued interest) - $6,915 = $98,085 total income

The holder of the premium bond receives more interest income, even though the discount bond has the higher yield of 2.57% versus the premium bond of 2.55%. Investors need to focus more on coupons rather than yield, because the income stream is from the coupon. These results show that the premium is not lost but is returned to the investor in the future at the coupon rate. The benefit of a premium bond versus a discount bond is that the interest income is elevated.

Below is a summary of the findings:

- Interest income is paid over the life of a premium bond, not loaded on the back end.

- The investor is swapping low-earning current cash for a cash flow stream (interest income) that will be paid in the future at the coupon rate – in this case 2.625%.

- The investor earns higher income with the premium bond.

- If rates rise, the investor has a higher aggregate income stream to redeploy the funds into other assets, e.g., loans or investments, and thus higher compounding of funds.

- On the other hand, if rates fall, the higher income stream becomes more valuable.

Catalyst Corporate’s Brokerage Team has the experience and knowledge to help your credit union effectively manage its investment portfolio. For more information, contact us today.

All securities are offered through CU Investment Solutions, LLC. The home office is located at 8500 W 110th St, Suite 650, Overland Park, KS 66210. CU Investment Solutions, LLC registered with the Securities and Exchange Commission (SEC) as a broker-dealer under the Securities Exchange Act of 1934. CU Investment Solutions, LLC is registered in the state of Kansas as an investment advisor. Member of FINRA and SIPC. All investments carry risk; please speak with your representative to gain a full understanding of said risks. Securities offered are not insured by the FDIC or NCUSIF and may lose value. All opinions, prices and yields are subject to change without notice.