By Paul Shorkey, CFA, FRM, Catalyst Strategic Solutions ALM Consultant

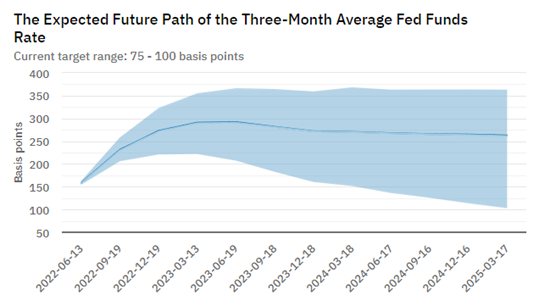

Whether it’s at the gas pump or in the supermarket, consumers are already feeling pressed by higher prices on daily necessities. The Federal Reserve Bank has increased interest rates 75 basis points (bps) and is poised to raise interest rates another 225 bps over the next year, according to market pricing.

What will this mean for your deposit offering rates over the same period? While the prior rate cycle witnessed 25 bps moves (maybe) every three months, this tightening rate cycle will see a more aggressive Federal Reserve squeeze if inflation remains at current elevated levels.

*Source: Federal Reserve Bank of Atlanta

Rising rates are a tool to control credit expansion and make saving more attractive than in prior rate cycles. The current rate cycle is seeing an unprecedented amount of liquidity on credit union balance sheets. This suggests that deposit betas, the percentage of change in the Federal Funds rate that credit unions pass through to depositors, will likely be even lower than the previous cycle. Although digital banks and Fintechs may bring greater competition for newer deposits, funding needs are currently too low to make this any real threat for credit unions with stable branch deposit inflows.

If inflation continues to press forward in the economy and the Federal Reserve actively works to counter this trend, industry experts expect an overall deposit beta of 6% in 2022, 17% in 2023 and 35% in 2024, with a cumulative beta of around 18% for the coming rate cycle.[1] This compares with cumulative betas of 25% in the most recent cycle, and 38% for the 2005 rate cycle when the Federal Funds rate went as high as 5.25%.

This low beta environment for the current credit cycle is good news for credit unions and will allow margins that have recently suffered to expand. This margin expansion, however, is not likely to be that dramatic due to the nature of the loan demand sought. On one hand, unsecured debt sought by cash-strapped households will create risky margins. On the other, cash-rich households with low borrowing needs will likely mean that prime credit lending rates may not even rise to deposit level betas due to competition. This has the potential to create a volatile credit cycle over the next few years.

While the increase in margins is good news for credit unions, this will be a challenging cycle for managing credit. With interest rates falling once again and margins coming under challenge, there is a strong possibility the Federal Reserve tightening could slow down the economy enough to cause a course reversal. Given the upcoming credit and interest rate challenges, selective credit lending and a well-balanced investment ladder could help stabilize the anticipated uncertainty.

Catalyst Strategic Solutions’ ALM Team is here to help guide you in your modeling of these instruments. Our comprehensive ALM service offering can accommodate your modeling needs, as well as provide professional advice around these assumptions. and add sensitivity analysis. For more information, contact us today.

[1] 2022 US Bank Market Report, S&P Global Market Intelligence, p. 12