By Jacob Bennett, Catalyst Strategic Solutions Data Analyst

Credit unions are an essential part of the financial services sector, serving millions of people around the world. Therefore, it is crucial they operate with the highest level of accuracy to make sound business decisions and provide the best possible services to their members. The quality of the data credit unions send and receive plays a vital role in achieving a high level of efficiency and precision.

Business data quality has become increasingly important over the years. A wide range of businesses, including credit unions, rely heavily on the integrity of their data to make executive decisions and gain insight into their own operations.

Why is it important for a credit union to send and receive quality data?

A credit union should be mindful of the data they send and receive for a multitude of reasons. A common saying in the data analytics field is, “garbage in, garbage out,” meaning the results are only as good as the information provided. Put bad data in, you get unreliable results. This often leads to poor financial reporting, unreliable analyses and wasted time and effort.

More importantly, you cannot make sound business decisions when the information you receive is unreliable. Credit unions are often required to track their financial performance to comply with NCUA regulations; errors in filed reports can lead to regulatory sanctions, as well as fines.

The future is uncertain. Recent spikes in inflation and high interest rates have undeniably opened our eyes to that truth. Credit unions are exposed to a variety of different risks, such as interest rate, liquidity and credit risks. With all this uncertainty, it is best to prepare now. Knowing exactly where the business stands helps management make better business decisions and plan ahead.

Quality data is useful for much more than just avoiding risk. It is also critical for innovation, tactical decisions and strategic planning. Financial institutions are constantly evolving and providing new services to members. Innovation is the key to staying relevant in a competitive world, but the products and services are only as good as the resources used to create them. Garbage in, garbage out. We all know data can “tell a story,” but it is important we are telling the right story.

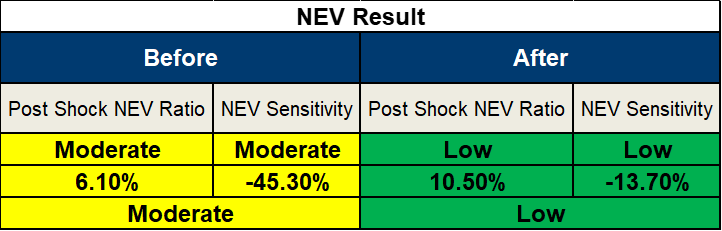

As an ALM Data Analyst, I sometimes see incomplete or inaccurate data submitted by clients. This can drastically alter their perceived financial position. One example is a credit union that sent us their initial data set, which reflected a relatively long duration for their mortgage portfolio and ultimately led to their placement in NCUA’s “moderate risk” category.

After numerous emails with the client, who was justifiably concerned about their assessment, we discovered the data provided was inaccurate. The mortgages they sent should have been modeled as “adjustable rate,” versus “fixed rate” mortgage loans. After updating the data, the credit union’s risk level was significantly reduced. The table below shows the significant difference in the credit union’s NEV volatility using the two sets of data. It clearly illustrates the benefit of sending valid and complete data to obtain accurate results and avoid wasted time and effort.

At a time when risk exposures are heavily scrutinized and regulatory pressures influence the business decisions you make, ensure your underlying data is accurate. It could be the difference between a moderate or high-risk exposure from a regulatory viewpoint, and it could have significant business implications.

Working with the data professionals on Catalyst Strategic Solutions’ ALM Team can help your credit union stay relevant, offer higher quality services, and avoid wasted time and money. Ensure your underlying data is accurate and complete. This will help improve risk identification and measurement, support innovation, and improve your overall strategic planning process. For more information, contact us today.