By Mark Wert, Catalyst Strategic Solutions, Senior Advisor

The COVID-19 pandemic – and its sudden, yet lingering presence – has taught us that nothing is impossible. With that in mind, credit unions have been forced to reexamine 2020 projections to include a new realm of possibilities. Should those possibilities include negative interest rates?

Here’s my thought progression when I hear the term “negative interest rates”: 1) Are they really something to consider? 2) How do they work? 3) Not happening. Federal Reserve Chair Jerome Powell recently rejected the idea for monetary policy; 4) Not in the U.S., We are the reserve currency; 5) However, some real interest rates are already negative…

As much as we want to deny the possibility of negative interest rates, the notion cannot be completely ruled out within the current economic climate. Therefore, it is beneficial to consider a few potential takeaways.

The concept of negative rates generally evokes bad connotations. Understandably so, as most people think negative rates cause capital destruction, attacking net worth and savings. Indeed, idle currency will lose money, which is why central banks want citizens to invest, purchase and spend to stimulate economic growth.

Capital destruction, at whose expense?

What if the U.S. government could issue zero coupon premium bonds? It would be good for the government, as it lowers U.S. cost of funds. But, what about the investor? It depends on a couple of factors. Buy and hold? Yes, you are locking in a loss. Available for sale or trading? It is no different than buying any positive yielding bond today. Once purchased, yields can go further negative, introducing capital appreciation, not depreciation.

At this point, it is well documented that Europe and Japan both have some form of negative rates. Whether it is a central bank policy rate (Japan -.10%, Switzerland -.75%), a 10-year German Bund yield (-0.50%), a risk-free curve in Switzerland or a mortgage in Denmark, we don’t know how negative rates will truly impact different economies. This leads to a plethora of questions, and negative rates have not been battle tested long enough to help answer any of them.

Back to the U.S.

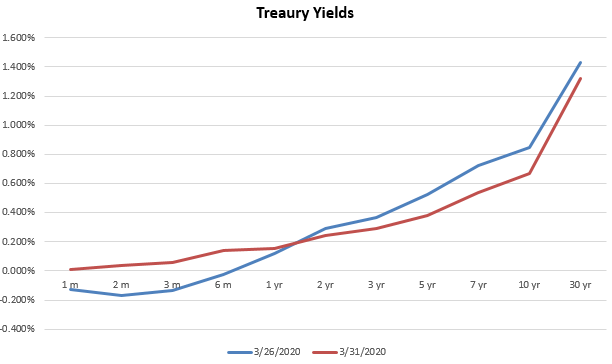

U.S. rates greater than overnight rates are primarily controlled by the market. Undoubtedly, the Fed can attempt to control term rates, but can they do it successfully? U.S. investors should note that at the end of March, the U.S Treasury yield curve was negative for maturities of six months or less. And, this scenario lasted several days.

It is also important to examine this topic in conjunction with real interest rates. To put it simply, nominal rates minus core inflation equals real rates. Therefore, if we subtract core inflation from the Fed’s target range, the policy range becomes

-1.50% to -1.25%. So, when it comes to real interest rates, the Fed’s policy reflects negative rates in real terms already. Perhaps that is how Europe and Japan have survived so far. We know the European Central Bank (ECB) and the Bank of Japan cannot generate inflation. Sound familiar?

The concept of negative interest rates is not going away any time soon and could potentially become a reality. Therefore, we must address the elephant in the room – are financial institutions ready? Similar to the Y2K scare at the dawn of the millennium, it’s a question of whether or not your systems can handle negative rates. Sure, you can charge fees on zero-interest-bearing deposit accounts to create negative returns, but can your credit union model its balance sheet using negative rates? Are you able to offer members loans at negative rates? What mechanics would it require? One question seems to lead to another, but it is important to brainstorm and rank the severity of any potential actions you may need to take. Generally, negative interest rates are seen as detrimental to the U.S. economy, as we do not fully understand the long-term consequences and capital declination is never beneficial. Although their arrival is not a foregone conclusion, they could be coming, so credit unions need to prepare from an operational standpoint.

Tools, like an industry rate comparison, can help your credit union monitor the current rate environment and assess its offering on a state-by-state or nationwide basis. Utilize market data and credit union-centric commentary to stay abreast of the latest economic developments.

The last time we got close to negative rates was during the Great Recession of 2008. Businesses prepared, but then caught a break. This time, we might not get that break. After all, anything is possible…

Catalyst Strategic Solutions’ Advisory Service is a comprehensive, SEC-registered program of customized balance sheet solutions and integrated ALM guidance. Our trusted team of Advisors offer a wealth of knowledge to help credit unions maneuver through various economic and interest rate environments. For more information, contact us today.