by

Catalyst Corporate | Dec 05, 2022

As we approach the end of 2022, credit unions find themselves in some tough positions. Liquidity is by far the most common challenge. Lending accelerated so fast that many institutions are running at thinner liquidity levels than they like. If you are in this position, what are your options, and what should you do?

Exploring the options

At a high level, almost every credit union has the same options available to them. They include selling securities, selling loans (direct or via loan participations), or taking on borrowings/non-member deposits. The strength and attractiveness of each option vary from credit union to credit union, and options can change rapidly with fluctuations in the overall market.

Option 1: selling securities:

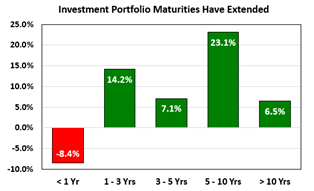

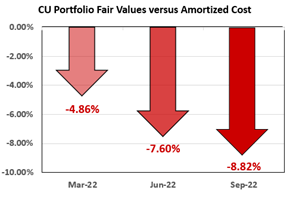

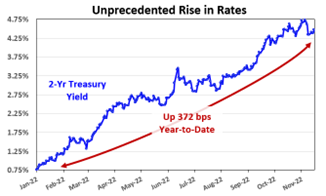

In more “normal” times when liquidity is tight, turning to your investment portfolio as a means of increasing liquidity is a common path. However, 2022 has been anything but normal. Interest rates shot up significantly and many investment portfolios are underwater at this point, so selling securities may not be high on the list of attractive options.

Option 2: selling loans (direct or via loan participations):

Loan participations have long been a tool for large and mid-sized credit unions to transfer excess loans to other credit unions. This option is attractive, because sellers maintain the capacity to continue originations, book potential gains and build up loan servicing income streams.

servicing income streams.

However, as with investment securities portfolios, loan portfolios have quickly become underwater, and pricing is not ideal. Those slow to respond have been swamped with volume as borrowers exploited the mispricing, and now even more loans are underwater than before. Even those credit unions increasing loan rates rapidly have been unable to keep up with the speed of market rate changes. That makes loan pricing a popular topic right now.

Option 3: Borrowing/non-member deposits:

Taking on borrowings and/or non-member deposits is another option for increasing liquidity. Less commonly used during normal times, there has been an uptick in external obligations over the past few months. Unlike the prior two options, taking on borrowings and non-member deposits inflates the size of your balance sheet when used to increase liquidity. The sale of securities and/or loan participations keeps the balance sheet size relatively stable. When net worth and equity capital ratios are under pressure, inflating total assets as a means of increasing liquidity may not be desirable. In addition to the increase in total assets, borrowings (like the prior two options) have a direct cost associated with them.

Which door should you choose?

Determining the “right” door for your credit union isn’t always easy. Each of the above options for increasing liquidity has a direct cost associated with it. This is known as the cost of liquidity. The cost of liquidity also incorporates the earnings drag from holding too much liquidity (i.e., cash) and not putting funds to work.

How do you choose the most appropriate option for you? The answer comes down to evaluating your costs. For example, borrowing from your line of credit is typically the fastest route to accessing liquidity, but it may not always be the most cost effective or financially advantageous option. Alternatively, if you need liquidity and it costs less to sell a loan pool than securities, select the loan pool sale. If securities are less expensive than the loan pool, sell the securities.

fastest route to accessing liquidity, but it may not always be the most cost effective or financially advantageous option. Alternatively, if you need liquidity and it costs less to sell a loan pool than securities, select the loan pool sale. If securities are less expensive than the loan pool, sell the securities.

In the current market, we see security portfolios priced at losses of 5% or more. Loan portfolios are being priced with losses of 3%, and borrowing rates are greater than 5% for most terms. Let’s dig deeper to compare the costs associated with these options.

-

First, let’s assume our security portfolio contains a 7% loss. For simplicity, all the investments carry the same 7% loss. If we sell a $1 million security, we will only receive $930,000 and realize the loss of $70,000.

-

Next, let’s assume a pool of auto loans could be sold as a loan participation for a 3% loss (priced at 97.0). If we sell a $1.1 million pool (knowing we must retain 10%) to get to a clean $1 million sale size, we will receive $970,000 and have a loss of $30,000. (Note: if you retain servicing on the portfolio, you will receive some earnings to offset this loss.)

-

Finally, let’s consider taking on a 2-year borrowing for $1 million at 5% (a fair proxy in this environment). The cost here is $50,000 per year over 2 years, so $100,000 total.

Let’s face it, no one wants to book a loss. But by avoiding the loss, you may be ignoring less costly strategies for generating liquidity. In the high-level analysis above, the loan participation sale emerges as the “least costly” option, whereas borrowing is most expensive for the credit union.

Certainly, a more in-depth analysis is required to make a final decision (we’ll take a deeper dive into those numbers in a follow up article). The key takeaway is to apply the cost/benefit approach to all your options. One option will usually shine brighter than the others.

Other considerations

Before making the final decision on current liquidity challenges, here are a few additional considerations:

-

If we consider the potential of a recession in 2023, it would be prudent to maintain strong access to secondary liquidity sources (i.e., borrowings). The sale of securities could impact borrowing capacity with our partners if these are used as collateral. The same is true for certain loan products that could be sold as loan participations (i.e., real estate loans).

-

While selling a security or a loan participation at a loss or below par may not be desired, you may find it is your best (and most affordable) option to ensure sufficient access to liquidity in the future.

-

If you are on the fence about selling a loan participation, issuing non-member deposits or taking on borrowings, we would be happy to discuss the pros and cons and help guide you to the lowest total cost option. Sometimes it will be securities, other times it will be a loan participation sale or external funds.

To find out more about the Loan Participation Exchange platform and how it can assist with your credit union’s liquidity levels, contact us today.