By Zane Wilson, Director of Brokerage Services (Retired)

You’ve likely seen articles predicting that mortgage rates will rise in 2021. The rationale for these predictions is complex, but when I think about the direction of mortgage rates, there is really only one major factor I consider: economic growth.

The rate of economic growth pretty much explains the “whole enchilada,” making it the primary focus. For example, when the economy gets better, bond yields rise and mortgage rates follow. When the economy slows, bond yields drop…and well, mortgage rates follow. We can expect mortgage rates to stick to the same pattern in 2021.

This year – before the 10-year Treasury yield broke below one percent – it was projected that if the U.S. went into a recession, the 10-year would trade between 0.21-0.62 percent. After hitting a new low of .34 percent in March, the 10-year yield has remained above 0.62 percent for most of the COVID-19 recession, and is even currently trading above 0.90 percent. Despite volatility in other sectors, this has been a consistently strong indicator that the bond market expects the economy to improve.

However, for mortgage rates to increase, one final variable must be realized: the 10-year Treasury yield needs to rise above one percent and remain within a range of 1.33-1.60 percent.

Time is running out to accomplish this in 2020, but it still remains within the realm of possibility. Here's a closer look at the top two factors that can either drive yields above one percent or prevent this from happening.

1. COVID-19 infection rates

The number of COVID-19 cases in the U.S. has been on the rise since early fall. If this trend continues – as anticipated – it could drastically increase hospitalization rates, thereby forcing the government to enact tighter restrictions again. Ultimately, this poses a potential threat to our economic stability. Without that, the risk to the economy isn’t as great as some might think.

It appears the nation may even be starting to adapt to the pandemic environment. As depicted in the chart below, recent retail sales data indicates that the American people are still consuming goods and services despite the growing threat of the virus. Following the drastic dip at the beginning of the crisis, retail sales have now surpassed pre-pandemic numbers. The economic stimulus package deserves credit for some of these gains. Secondly, the fear of COVID-19 has partially faded from American behavior, so we’ve gone from hoarding toilet paper to buying homes and purchasing more stuff online.

But even with government aid, it’s impossible for the U.S. economy to run anywhere near full capacity as long as the virus is still active. And although we’ve seen V-shaped recovery data in multiple sectors, certain parts of the economy are still treading water at best. Just look at energy prices as a prime example of this.

Eventually, we’ll have a vaccine to fight the virus – the missing link to getting our economy back on pace for slow and steady growth like that of the previous economic expansion, which was the longest in U.S. history.

2. The election and future economic relief efforts

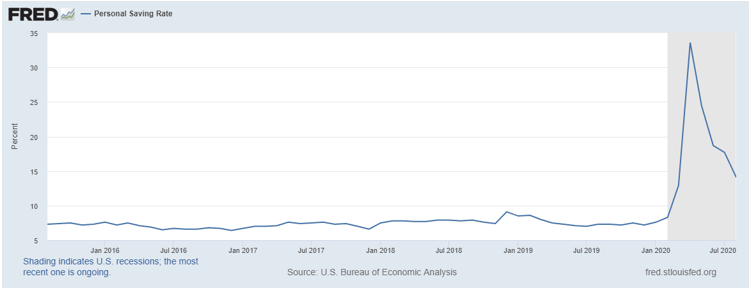

The Coronavirus Aid, Relief, and Economic Security (CARES) Act – distributed to millions of Americans earlier this year – lived up to its economic objective. As evident in the chart below, this year’s real disposable income and personal savings rate has exceeded pre-pandemic levels due in part to the fiscal aid. Even as initial effects of the enhanced unemployment benefits and $1,200 stimulus subside, personal savings and disposable income remain higher than 2019 levels.

Without the economic stimulus package and other monetary actions from the Federal Reserve, we project that the 10-year Treasury yield would still be in the recessionary range of 0.21–0.62 percent. Therefore, it’s critical to continue distributing coronavirus relief to the economically distressed until the unemployment landscape dramatically improves.

Key takeaways

With the upcoming presidential transition, rising COVID-19 cases and an ongoing dispute over future relief plans, there’s no shortage of socioeconomic factors on the horizon. Just remember the bond market always jumps ahead of consistent economic growth, even if growth is between 1-2.5 percent. So, we want to see higher bond yields and mortgage rates, as that indicates the last few economic sectors damaged by COVID-19 are healing.

Once the 10-year Treasury yield surpasses one percent, we can check off the last variable at hand. But, where 2021 mortgage rates head will ultimately come down to the level of economic growth and how the above factors play out in the coming months.

You don’t have to navigate these rate complexities alone. Catalyst Corporate’s Brokerage Team offers a wealth of knowledge to assist with all your credit union’s investment planning needs. Contact us to learn more.

All securities are offered through CU Investment Solutions, LLC. The home office is located at 8500 W 110th St, Suite 650, Overland Park, KS 66210. CU Investment Solutions, LLC registered with the Securities and Exchange Commission (SEC) as a broker-dealer under the Securities Exchange Act of 1934. CU Investment Solutions, LLC is registered in the state of Kansas as an investment advisor. Member of FINRA and SIPC. All investments carry risk; please speak with your representative to gain a full understanding of said risks. Securities offered are not insured by the FDIC or NCUSIF and may lose value. All opinions, prices and yields are subject to change without notice.