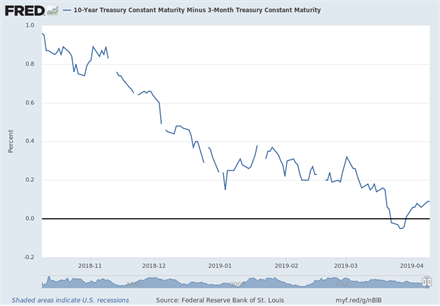

A closely-monitored measure of the Treasury yield curve briefly inverted a few weeks ago. The yield on the 10-year Treasury note fell below the yield on the 3-month T-bill (see chart below), unsettling equity investors worried about a potential recession.

The inversion of the 3-month to 10-year Treasury yield spread came about as bond yields around the world fell. Disappointing economic indicators from the European Union confirmed fears of slowing growth in a region that was already reeling from a trade slowdown and Brexit uncertainty. Stock investors flocked to the safe haven of Treasury securities, driving yields down. Around the same time, the FOMC cut its interest rate-hike projections from two to none, and Fed Chairman Jerome Powell cited global economic slowdown and tame inflation as reasons for caution.

Yield curve basics

The Treasury yield curve is a line that plots Treasury yields across maturities ranging from three months to 30 years. Typically, the Treasury yield curve is upward-sloping, providing higher yields for investors who hold longer-term securities that are subject to inflation risk and other uncertainties. An inverted Treasury yield curve can be a concern for a variety of reasons: investors may be worried about future economic growth, so long-term Treasury securities are favored, or overly tight monetary policy has short-term rates elevated, causing a slowdown in the economy.

A general inversion of the Treasury yield curve can be seen as a reliable warning of a potential recession within a year or two. Inversions have preceded every U.S. recession going back to 1955, with only one false positive. While inversions of other portions of the curve have also served as recession indicators, many economists believe that the 3-month to 10-year Treasury spread is the most reliable. Inversions of the 3-month to 10-year spread have preceded each of the past seven recessions, including the 2007-2009 contraction, and have offered only two false positives – an inversion in late 1966 and a very flat Treasury yield curve in late 1998.

Should we be worried?

A recession is not a certainty. Some economists have argued that the aftermath of the Federal Reserve’s quantitative easing measures, during which global central banks bought up government bonds, may have robbed yield curve inversions of their reliability as a predictor. Since so many Treasury securities are held by central banks, the Treasury yields can no longer be seen as market-driven. The Fed may have created an artificial yield curve that they cannot wind down for years.

The yield curve has been flattening for some time, and it’s possible the 3-year to 10-year Treasury yields would need to be inverted for a sustained period to signal a recession, instead of inverting for just a few days.

We cannot ignore a rising recession risk, but for now, it has largely been a story of global growth concerns. If the global economy continues to deteriorate, however, the U.S. will feel the negative effects. On the positive side, if the Administration can resolve trade agreement/tariff issues, we should see a bump in equities, Treasury yields and economic growth.