By John Kirby, Investment Officer

Opportunity cost is defined as the loss of potential gain from other alternatives when one alternative is chosen. When applied to the concept of a credit union balance sheet, it relates to keeping excess deposits in cash when new loans or investments are an available option.

Over the last few months, credit union loan demand has ebbed and flowed under the cloud of the coronavirus. Mortgage lenders may have seen strong growth from all the new and refinanced loans that have been originated at historically low rates. Business lenders also may have experienced a spike from the Paycheck Protection Program loans (PPP), a component of the Coronavirus, Aid, Relief and Economic Security (CARES) Act. However, auto loans are the bread and butter for most credit unions, and, sadly, that same growth has not translated to the auto sector. Nationwide, auto sales fell from 17 million units in April 2019 to just over eight million units in April 2020 – with only a mild rebound of 12 million units in May.

This soft loan demand has left many credit unions with more cash than usual. Additionally, recent data shows that members aren’t spending their tax returns, stimulus checks or tax refunds – plausibly, over economic security concerns. The question is, “Will these deposits remain “sticky?”

How much is your cash costing you?

As recently as February 2020, most – if not all – cash positions were paying in excess of 1%. Then came the economic fallout from COVID-19, and in a matter of weeks, rates bottomed out to the same near-zero rate environment investors dealt with at the end of the 2008 financial crisis. Overnight, cash positions fell to single-digit basis points.

With that in mind, the decision to maintain a cash surplus, while awaiting increased loan demand, is understandable when you’re earning a liquid 1% yield – especially when you were lucky to get a 2% yield on a mortgage-backed security (MBS). But, the game has changed.

For ease of illustration, I’ll use the example of a credit union with $100 million in assets, 20% of which is currently in an overnight account, unable to generate new loan deployment due to lack of demand. The $20 million, earning a generously estimated yield on its overnight position of 0.05%, is just $10,000 in annualized interest income. However, investing in a one-year certificate of deposit (CD) with a 0.20% yield can result in $40,000 in income per year. Increase that yield to 1.00% on a conservative new MBS with a four-year average life, and we’re talking about $200,000 in additional annual investment income for that credit union. While oversimplified for illustration sake, the math demonstrates the key point at hand.

In February, moving from the 1% yield of cash to the 2% yield of an MBS pool meant effectively doubling your earnings on that position. With overnight rates as they stand, an MBS investment will now net you about 20 times what you are earning in cash. Looking through that lens, the effective management of your cash position is a key component to maintaining strong earnings until loan demand picks up again.

CU Cash Positioning Tools

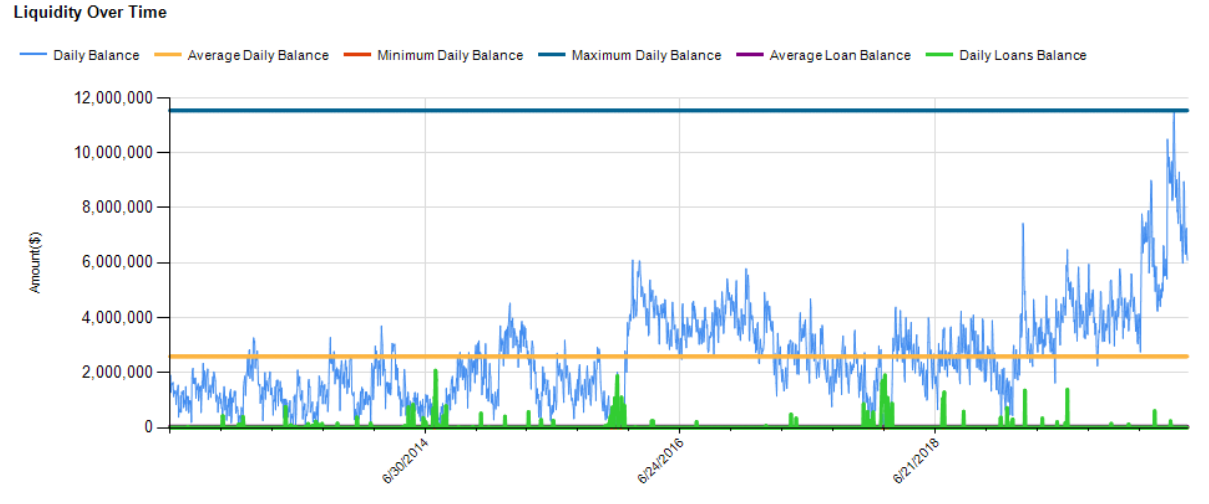

Catalyst Strategic Solutions’ Liquidity Analysis Tool shows the daily cash balances of credit union accounts and provides a series of average daily balances to aid the decision-making process.

And, for a quick, “on-the-fly” analysis, the What-If Online model provides instant ALM results to help with cash positioning. Accessible via TranZact, the model allows our current ALM clients to test hypothetical investment purchases, and their balance sheet impact, against recent ALM data.

And, for a quick, “on-the-fly” analysis, the What-If Online model provides instant ALM results to help with cash positioning. Accessible via TranZact, the model allows our current ALM clients to test hypothetical investment purchases, and their balance sheet impact, against recent ALM data.

It’s not easy to commit to an investment purchase when you’d rather make a loan. It’s also not easy to determine how much cash to commit to a purchase with so much lingering uncertainty. This is where the knowledge and experience of the Catalyst staff come into play.

Our Brokerage Services team has years of service dedicated to the credit union and investment industries, and we work diligently to find securities that meet the unique needs of each credit union we support. Reach out to our team of dedicated professionals for a review and discussion of your portfolio and available options. Allow us to show you how our knowledge and experience can benefit your credit union.

All securities are offered through CU Investment Solutions, LLC. The home office is located at 8500 W 110th St, Suite 650, Overland Park, KS 66210. CU Investment Solutions, LLC registered with the Securities and Exchange Commission (SEC) as a broker-dealer under the Securities Exchange Act of 1934. CU Investment Solutions, LLC is registered in the state of Kansas as an investment advisor. Member of FINRA and SIPC. All investments carry risk; please speak with your representative to gain a full understanding of said risks. Securities offered are not insured by the FDIC or NCUSIF and may lose value. All opinions, prices and yields are subject to change without notice.