By Chris Shipman, CFA, CFP® Catalyst Strategic Solutions Advisor

If the year 2020 could be characterized, I would relate it to Uncle Eddie, from National Lampoon’s Christmas Vacation – great intentions, but always seems to say or do the wrong thing. As we reflect, the year started with great intentions. After all, we were in the longest bull market in U.S. history, with no real end in sight. There were no meaningful asset bubbles and businesses were strong. Then the pandemic hit, and it has been the gift that keeps on giving.

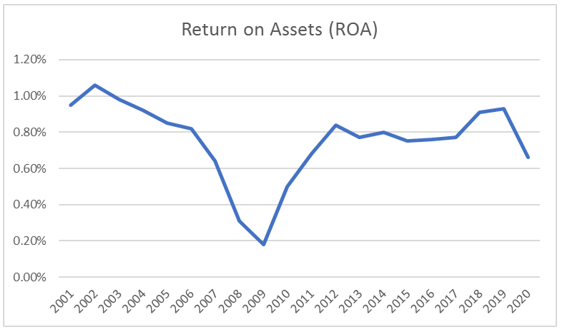

One of those gifts has been growth in deposits and, in turn, assets. Unfortunately, this rapid growth has contributed to an unexpected decline in return on assets (ROA). According to NCUA data, the industry’s ROA has gone from 0.93 percent in December 2019 to 0.66 percent as of September 2020, a decline of 29.0 percent. Furthermore, the imbalance between the 16.1 percent growth in assets and the 2.9 percent growth in earnings has resulted in a declining net worth ratio. To put 2020’s change in ROA into perspective, the past two recessions (2001 and 2008) caused ROA to decline 6.7 percent and 51.6 percent, respectively. That said, when the economy normalizes, ROA profiles generally rebound rather quickly (see chart below). As we look to 2021, ROA is expected to follow a similar path but could increase if net interest margin increases.

A simple way to enhance earnings is to proactively manage excess liquidity. With most credit unions maintaining excess liquidity in a cash account earning interest on excess reserves (IOER), redeploying this cash into a higher yielding asset is financially worthwhile. With IOER expected to remain at 0.10 percent through 2023, the annual interest earned on $1 million would be $1,000. However, if this same $1 million is placed in a two-year agency bullet yielding 0.21 percent, the interest earned would be $2,100, which increases your interest earned by $1,100. Naturally, where you choose to allocate the excess cash will alter your earnings performance and potential risk profile, but it’s worth examining.

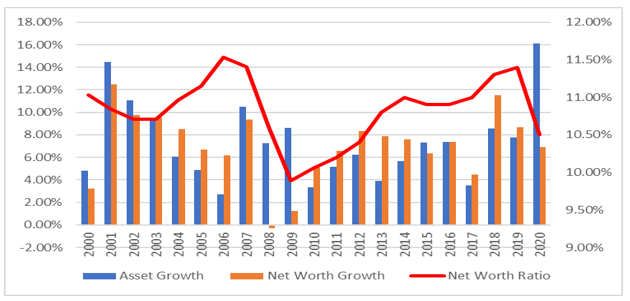

Another notable trend this year has been the industry’s diluted net worth ratio due to significant growth in assets. Despite the current recession, net worth continues to increase, but at a much slower pace than asset growth. As depicted in the graph below, the last time the industry experienced a decline in net worth was during the 2008 recession, contracting 29 basis points but rebounding in subsequent years.

In summary, the gifts given to us in 2020 have provided the foundation for a strong 2021. The industry remains well-capitalized, and with ample liquidity, we are in a unique position to grow loans and magnify our earnings profiles with the additional assets we have to leverage.

In summary, the gifts given to us in 2020 have provided the foundation for a strong 2021. The industry remains well-capitalized, and with ample liquidity, we are in a unique position to grow loans and magnify our earnings profiles with the additional assets we have to leverage.

Catalyst Strategic Solutions’ team of experienced Advisors has the knowledge and insight to help your credit union successfully plan for the year ahead. For more information, contact us today.