By Al Schiliro, Senior Investment Officer

The 9/11 terrorist attacks, the Great Recession of 2008, and now…COVID-19. The health and economic crisis brought on by the global pandemic is arguably the third major outlier event of our generation. Each catastrophe triggered a new wave of economic turbulence and required considerable adjustments to credit union balance sheets. From loans to investment options, much of the economic landscape was altered by these exogenous events.

From an investment management perspective, credit unions that invested to build and maintain a well-balanced portfolio appear to have been most successful in weathering the storms. I know that’s easier said than done. Talking to an investment professional is sometimes like talking to an economist – consult 10 individuals and you will get 20 different answers. While there’s no “one-size-fits-all” approach to maintaining a well-balanced portfolio, observations from my 35 years of experience in investment services have shed light on a few key characteristics.

Build stability with a well-balanced investment mix

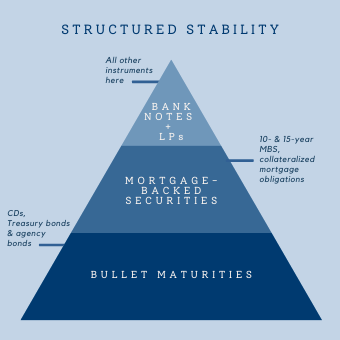

A well-balanced portfolio starts with a sound infrastructure. It’s the ballast that keeps the portfolio strong and helps with modeling and lending stability, offsetting any optionality  that is inherent in other investment vehicles. The stability is derived from bullet maturities – non-callable instruments, such as certificates of deposit (CDs), U.S. Treasury bonds and agency bonds – that pay a semi-annual cash flow and remain on the balance sheet until they mature. Mortgage-backed securities (MBS) with 10- and 15-year maturities, are the perfect complement to bullet maturities, as MBS are an amortizing investment that can provide additional yield. Credit unions can also incorporate collateralized mortgage obligations (CMOs) into the MBS segment for more targeted cash flows. Lastly, there are two other instruments that can be integrated into a credit union investment policy: bank notes, which are predominantly a bullet (non-callable) instrument, and loan participations.

that is inherent in other investment vehicles. The stability is derived from bullet maturities – non-callable instruments, such as certificates of deposit (CDs), U.S. Treasury bonds and agency bonds – that pay a semi-annual cash flow and remain on the balance sheet until they mature. Mortgage-backed securities (MBS) with 10- and 15-year maturities, are the perfect complement to bullet maturities, as MBS are an amortizing investment that can provide additional yield. Credit unions can also incorporate collateralized mortgage obligations (CMOs) into the MBS segment for more targeted cash flows. Lastly, there are two other instruments that can be integrated into a credit union investment policy: bank notes, which are predominantly a bullet (non-callable) instrument, and loan participations.

To visualize this concept, think of a pyramid. Bullet maturities are at the bottom, forming the base. The next layer contains MBS instruments, with all other investment options filling in the top of the pyramid. Weighted according to its shape, the bullet and MBS layers constitute a large majority of the investment allocation and overall portfolio.

Credit unions may also want to consider extending bullets into the five-year range. This would be a small segment, but at some point in the next interest rate cycle, it may prove beneficial with higher yields.

Look beyond yield

Meeting liquidity demand and providing income are the primary objectives of most investment portfolios. However, I see many credit unions focusing on yield alone, limiting their investments to only CDs, only new issue bullets, only new issue callables, etc. The pandemic ruthlessly exposed the challenges with such a one-sided investment strategy. Ultimately, maintaining a well-balanced portfolio is key to weathering different interest rate, business and external cycles that may occur over time.

Credit unions have a large advantage with their not-for-profit structure. The goal is not to time or think you know more than the market. Concentrate on risk mitigation and building a sound, balanced portfolio that will meet liquidity demands and provide competitive income to sustain the entity. This is not a strategy for “the now,” as that ship has sailed. It can, however, serve as a template for the next interest rate cycle.

Catalyst Corporate’s team of seasoned investment professionals can help you develop an investment strategy that will benefit your credit union over the long run. For more information, contact us today.

All securities are offered through CU Investment Solutions, LLC. The home office is located at 8500 W 110th St, Suite 650, Overland Park, KS 66210. CU Investment Solutions, LLC registered with the Securities and Exchange Commission (SEC) as a broker-dealer under the Securities Exchange Act of 1934. CU Investment Solutions, LLC is registered in the state of Kansas as an investment advisor. Member of FINRA and SIPC. All investments carry risk; please speak with your representative to gain a full understanding of said risks. Securities offered are not insured by the FDIC or NCUSIF and may lose value. All opinions, prices and yields are subject to change without notice.