By Mark DeBree, CFA, Managing Principal, Catalyst Strategic Solutions

Credit unions have had access to interest rate derivatives as a risk management tool for years. Gaining the authority to use them, however, presented a challenge many credit unions simply did not want to tackle. Fortunately, NCUA’s recently proposed rule will make it easier for credit unions to incorporate derivatives into their balance sheet management practices.

Although derivative usage within the industry remains low, a couple of key considerations may prompt credit unions to take a closer look at this powerful tool.

We all need more ‘tools’

Having more, rather than fewer, tools at your disposal is usually better. In my garage, for example, I have three different drills. Each drill could be used for multiple purposes, but when it’s time to put a hole in concrete or brick, there’s only one drill that works effectively. For this job, I pull out my hammer drill, which is uniquely designed for drilling through extremely hard surfaces. On the other hand, if I need to drill through glass or tile, a hammer drill is the last choice, because the hammer action would crack the surface.

In a similar way, credit unions often turn to borrowings as a tool they’re comfortable with to hedge interest rate risk on their balance sheet. This can be useful, reducing risk almost as effectively as an interest rate swap. But sometimes, using borrowings as an interest rate risk management tool may not be the best choice.

For example, the current inflow of deposits has pushed asset levels up materially in less than a year, while the corresponding drop in interest rates has produced downward pressure on earnings. These two events together have many experiencing pressure on capital levels. With net worth already under pressure, is further inflating the balance sheet by using borrowings for interest rate risk management the best path? I would argue that it’s not.

Borrowings vs. interest rate derivatives

Interest rate derivatives, when used effectively, are off-balance sheet items, which means you can enjoy the risk management benefits without inflating the balance sheet. In other words, reduce risk without placing additional downward pressure on net worth.

Using borrowings to lower interest rate risk, especially during periods of heightened uncertainty, also ties up external liquidity capacity at a time when liquidity could become extremely important. Essentially, this would reduce interest rate risk exposures, but end up increasing liquidity risk exposure in the process. From an enterprise risk management position, I think it’s best to keep some of our “powder dry” and ensure we have access to as much external liquidity as possible.

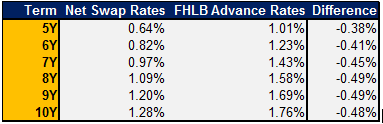

Additionally, the cost of an interest rate swap relative to borrowings is lower. To effectively hedge a pool of new 30-year mortgages, a credit union would typically apply a 7-year borrowing to offset the interest rate risk of the mortgages. At the time of this writing, the net interest rate (pay fixed rate less the receive floating rate) for a 7-year term swap was almost 50 basis points lower than term borrowings from the Federal Home Loan Bank. The lower cost of interest rate swaps relative to borrowings means more earnings flowing to the bottom line for credit unions. In dollar terms, if a $20 million notional swap was used instead of borrowings, the interest savings would be close to $100,000 annually! Who wouldn’t want to add $100,000 to the bottom line by simply using a different tool?

Managing risk on low-rate mortgages

Finally, the decline in mortgage rates combined with the uptick in production that credit unions are experiencing makes many credit union executives and board members increasingly uncomfortable booking mortgage loans. To manage this risk, many credit unions are turning to Catalyst Corporate to help with participating out loan pools or selling them directly on the secondary market. This brings cash back to the credit union for them to redeploy…but where and at what rate?

Should you originate and sell mortgages only to find your organization investing in securities? If so, you may find yourself on the wrong side of the yield trade. When you sell your members’ mortgages and enter the investment market, you are now (thanks to quantitative easing measures) competing with the Federal Reserve, which is buying heavily in the mortgage securities market – ultimately pushing up prices and lowering yields. This is where interest rate derivatives can help. A proper strategy can significantly reduce the interest rate risk added by the low-rate mortgages, while still enabling your credit union to enjoy most of the earnings stream. In fact, there are ways to maintain a stable interest rate risk exposure and increase the bottom-line benefit to your credit union and its members.

In summary, interest rate derivatives can be extremely valuable. The proper application of a derivative strategy relative to borrowings can help keep your balance sheet from expanding, stabilize or even lower your interest rate risk position, maintain full access to external liquidity, and improve your bottom line. For credit unions concerned about risk, or looking to expand their presence in the real estate markets, it may be worthwhile to explore whether interest rate derivatives are an appropriate fit. They behave a little differently, so do your research or reach out and we can walk you through the details. Your discovery process may reveal the products do not align with your needs or comfort levels, but taking the opportunity to evaluate this tool can be beneficial.

If you need more information on interest rate derivatives, Catalyst Strategic Solutions stands ready to support the industry. As a credit union-owned solution, our goals align with yours. We are here to help you manage your balance sheet effectively, so contact us today.