By Cassandra Kowieski, Catalyst Strategic Solutions ALM Consultant

Nearly halfway into 2021, we are still in the throes of a pandemic-induced low-rate environment, but there are signs of brighter days, growth and a steepening yield curve. Is now the right time to consider servicing mortgages, and if so, what should a potential mortgage servicer consider, given the current market?

What is MSR?

Mortgage Servicing Rights (MSR) refer to an arrangement in which a third party collects mortgage payments from a borrower and then forwards those payments to the lender. The servicer, as the middleman between the borrower and the lender, collects a fee for servicing. The servicer has a contract that lays out specific duties to be performed. Duties generally include:

- Collecting full payment from the borrower

- Distributing principal and interest from the payment

- Managing escrow funds

- Tracking payments

- Handling default loans (when applicable)

How do you value MSR?

First, why would a credit union want to become a mortgage servicer? Easy. Increased revenue, right? After all, MSR is the capitalization of the right to receive future payments from borrowers for servicing loans on behalf of the lender.

To back into the capitalized value or market value of MSR, start with the current value of the mortgage loans over their lifetimes. Cash flows from projected earnings are then discounted to take the time value of money into consideration.

The MSR valuation should include appropriate assumptions. Prepayments have a significant impact when evaluating MSRs. Prepayment speeds reflect how quickly the borrower repays a mortgage prior to the scheduled maturity date. As interest rates fall, prepayment speeds generally increase. Faster prepayment speeds drive down outstanding balances, reducing the amount of income a servicer earns, and ultimately lower the value of the servicing asset.

The discount rate is another important component of MSR assumptions. The discount rate is used to determine the present value of the loans. Keep in mind, the discount rate applied to a servicing asset is not the same as it would be for the full loan. Typically, it is much higher because the income variability and risk are much higher. Remember, a servicer does not own the property, so the servicing rights are not collateralized!

The cost of servicing these assets is another critical component, and arguably the most significant assumption when determining value of a servicing portfolio. The servicing cost is simply how much it costs to service a loan on an annual basis. This number can range widely from credit union to credit union based on scale and efficiency of operations. As a result, the cost/benefit of servicing loans at any credit union often is associated with sufficient size of the servicing portfolio.

Another exposure includes operational risk. Servicing mortgage loans is an ongoing process. The servicer will need to continually monitor current market conditions, identify potential risks to the loans and calibrate cash flows as needed. Next, factor in continual monitoring and improving the MSR valuation process. Credit risk must be factored in as well. What if the borrower loses his or her job and does not have the capacity to repay the loan? Or, what if the borrower is re-employed but needs to renegotiate payment terms?

What’s going on in the mortgage marketplace?

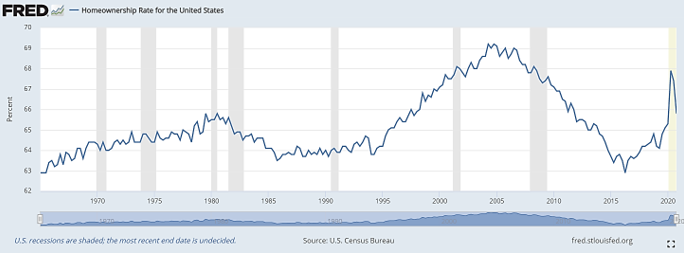

One might think home sale prices would decrease during a recession and a pandemic; however, with low inventory and high demand, home sale prices have increased notably during this seller’s market. Who is buying up all the houses? The pandemic created a work- and school-from-home scenario, causing many homeowners to want new, larger homes for extra home office, classroom or entertainment space. However, per National Asset Service (NAS), the largest share of homebuyers in the U.S. is currently millennials. Millennials are recognizing the cost-effectiveness of purchasing versus renting a home. Combined with low interest rates brought about by the pandemic, a perfect environment exists for millennials to purchase homes.

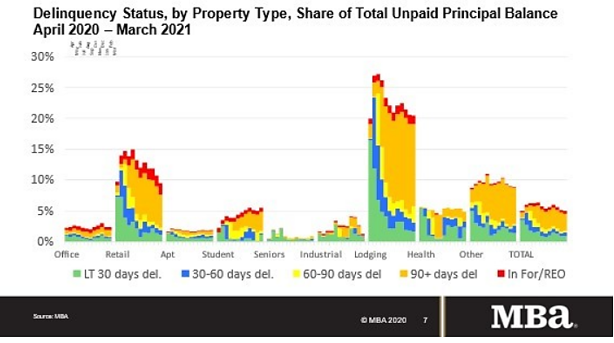

Declining mortgage loan delinquencies should be noted as well. The Mortgage Bankers Association reported that delinquency rates decreased in March 2021 for the third month in a row (see chart below).

Declining mortgage loan delinquencies should be noted as well. The Mortgage Bankers Association reported that delinquency rates decreased in March 2021 for the third month in a row (see chart below). The MBA developed its CREF Loan Performance Survey during the COVID-19 pandemic, specifically to track changes to the delinquency status of commercial and multifamily loans. Key findings from the March 2021 survey include:

The MBA developed its CREF Loan Performance Survey during the COVID-19 pandemic, specifically to track changes to the delinquency status of commercial and multifamily loans. Key findings from the March 2021 survey include:

- The number of commercial and multifamily mortgages that are not current on payments decreased in March to the lowest level since April 2020.

- 95.0 percent of outstanding loan balances were current, up from 94.8 percent in February.

- 3.2 percent were 90+ days delinquent or real-estate owned (REO), down from 3.5 percent a month earlier.

- 0.3 percent were 60-90 days delinquent, unchanged from a month earlier.

- 0.5 percent were 30-60 days delinquent, down from 0.6 percent a month earlier.

- 0.9 percent were less than 30 days delinquent, up from 0.8 percent a month earlier.

When do servicing rights make sense?

For credit unions considering servicing, initiating a program during a period of rising interest rates and slowing prepayments may make a lot of sense. The earnings potential of servicing rights increases as more servicing assets are added to the portfolio. Additionally, stable or slowing prepayments help produce a consistent, possibly growing, income stream. As interest rates turn and refinancing activity begins to accelerate again, servicing income and valuations will likely decline.

However, because mortgage servicing rights offer an inverse relationship to changing interest rates relative to the rest of the balance sheet, they can present a great opportunity to hedge earnings volatility from on-balance sheet assets.

What to make of all this?

Mortgage servicing should always be approached strategically and with caution. However, periods of high mortgage volume and slowing prepayment speeds may be the ideal time to get your feet wet. Understanding what drives servicing valuations will inform expectations regarding the earnings potential and risk associated with these assets. Still have questions? The Catalyst Strategic Solutions ALM Team can help. Contact us for more information today.