By Andrew Gelsomini, Catalyst Strategic Solutions Advisor

Subordinated debt has remained at the forefront of credit union strategic initiatives throughout 2022 and into 2023, despite rising interest rates.

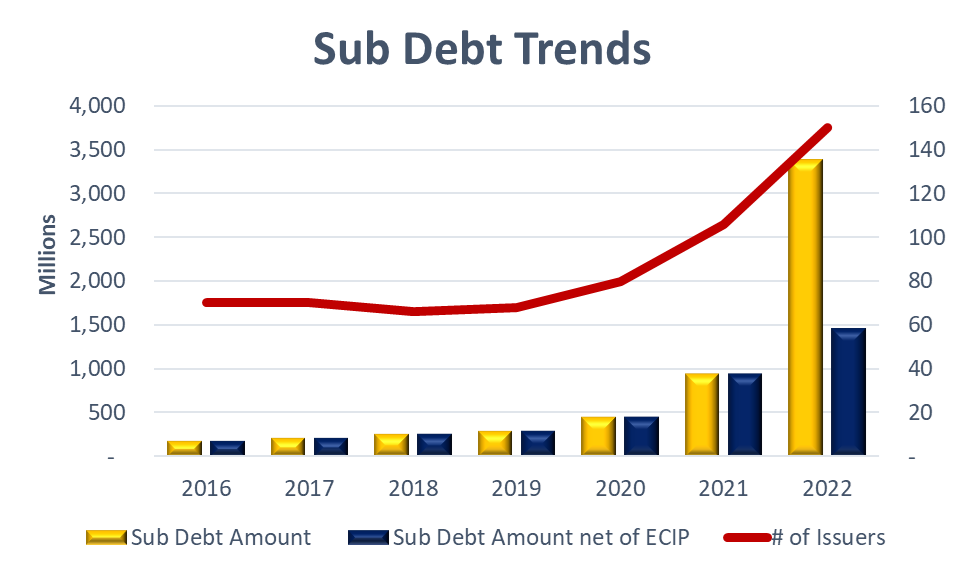

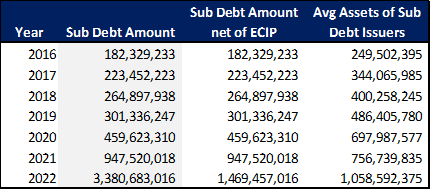

As depicted in the chart below, total outstanding subordinated debt increased to over $3 billion by the close of 2022. The U.S. Treasury Emergency Capital Investment Program (ECIP) played a large part of this expansion, awarding $1.9 billion to credit unions in 2022.

Even after adjusting for ECIP distributions, direct subordinated debt issuances increased from $950 million at the close of 2021 to $1.5 billion at the end of 2022, representing a 50% increase during the year. Upon further examination, the total amount outstanding at the end of 2016 was only $182 million. That means since 2016, total direct issuances (excluding ECIP) have increased by $1.3 billion, or 706%.

In addition to subordinated debt issuances increasing the past several years, the types of credit unions issuing subordinated debt have also changed. In 2016, the average asset size of credit unions issuing subordinated debt was $250 million. By year-end 2022, this increased to over $1 billion.

What is driving growth in subordinated debt?

Traditionally, the long-term asset growth rate of a credit union is limited to the long-term growth rate in earnings. Stated differently, if long-term asset growth exceeds the rate of earnings growth, your net worth ratio will eventually decline to unsafe levels.

Subordinated debt issuances can potentially solve this challenge by adding net worth upon issuance. This additional net worth enables credit unions to enact those strategic growth plans without the same concerns on their net worth ratios.

What are credit unions doing with subordinated debt funds?

While there is no sole industry standard for the use of funds, credit unions commonly pursue a few high level strategies. These strategies can be broken down into three primary categories:

- Support expansion

- Support internal investment

- Improve market penetration

You’ll notice that these three categories revolve around growth. Credit unions are using the funds to fuel growth in new markets, invest within existing markets, or invest in their own institution to improve current operations and delivery systems.

What is the cost associated with subordinated debt?

Subordinated debt notes are uninsured and unsecured obligations issued by credit unions. As a result, they carry a higher cost than other debt structures issued by credit unions, but this shouldn’t automatically be a deterrent. Sub debt offers a significant advantage that other debt instruments do not – net worth treatment.

The fact that subordinated debt can be treated as direct net worth enables issuers to increase assets and deposits at a factor of at least 5-10 times the amount of the subordinated debt issuance. This leverage factor enables the issuers to generate loans in amounts well above the debt issuance, which means that earnings capacity of new loans can often dwarf the cost of the subordinated debt issuance.

Is subordinated debt right for you?

While subordinated debt is deservedly gaining attention, it may not meet the individual needs of every credit union. The value of the sub debt strategy hinges on the growth potential of your credit union. If you are trying to determine whether you should consider subordinated debt, ask yourself this: “If I had more net worth, could my credit union expand and produce loans that are at least two times the amount of debt we’d issue?” If the answer is yes, sub debt could be a tool to help your credit union achieve its full potential.

When you are ready to talk and want a partner that both supports the credit union industry and works in your best interest,

contact Catalyst’s team of subordinated debt experts.

All securities are offered through CU Investment Solutions, LLC. The home office is located at 8500 W 110th St, Suite 650, Overland Park, KS 66210. CU Investment Solutions, LLC registered with the Securities and Exchange Commission (SEC) as a broker-dealer under the Securities Exchange Act of 1934. CU Investment Solutions, LLC is registered in the state of Kansas as an investment advisor. Member of FINRA and SIPC. All investments carry risk; please speak with your representative to gain a full understanding of said risks. Securities offered are not insured by the FDIC or NCUSIF and may lose value. All opinions, prices and yields are subject to change without notice.