By Paul Shorkey, CFA, FRM, Catalyst Strategic Solutions ALM Consultant

In 2009, the Federal Reserve instituted an annual Comprehensive Capital Analysis and Review (CCAR) for Systemically Important Financial Institutions (SIFIs). One of many efforts to restore confidence in the banking system following the 2008 financial crisis, this program was intended to fend off potential contagion in the banking sector in the event of another severely adverse credit default.

The CCAR process is complicated and no credit unions fall under its jurisdiction; however, the Dodd-Frank Act later expanded stress testing to include smaller, but nonetheless important, banks and credit unions. Known as DFAST, this stress testing must be performed by credit unions with greater than $10 billion in assets.

The essence of this stress test is to examine the impact of a severe economic event on a credit union’s capital. This involves projection of the balance sheet, net interest income (NII) and provision for loan loss over the subsequent nine quarters from fiscal year end (FYE). Unlike an interest rate shock or ramp, which only looks at NII (i.e., a sensitivity test), the DFAST stress test looks at both NII and credit losses with a scenario analysis.

How DFAST works

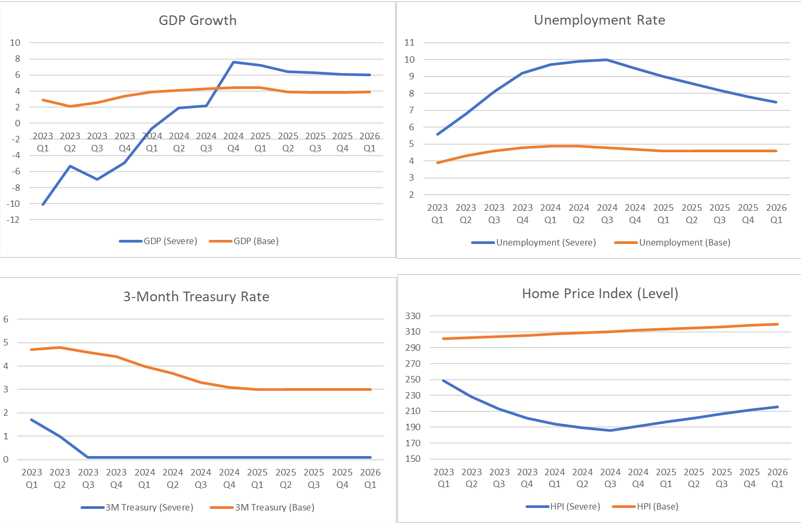

The Federal Reserve publishes the primary factors for the scenario, which include measures of economic activity and prices (changes in GDP and personal income, the Consumer Price Index, the unemployment rate), asset prices or financial conditions (real estate and equity prices, stock market volatility), and interest rates (3M, 5Y, and 10Y UST rates, 10Y BBB corporates rate, 30Y mortgage rate, prime rate). The Fed then prescribes a “Baseline” and a “Severely Adverse” scenario based on these factors.

Although the prescribed scenarios serve a purpose, the Fed also encourages using internally designed scenarios based on a credit union’s unique market. For example, a credit union may have a member segment with an idiosyncratic correlation to risks on the balance sheet. The credit union would want to identify these risks and create a scenario that could potentially play out based on those risks.

The critical exercise in performing the stress test is projecting the change in projected balances, NII and provision for loan losses. While an ALM model can project NII, the loan loss provision projection will involve use of statistically driven credit loss models for each distinct loan type that projects default rate and recovery rate. Special attention should be paid to the integration of interest rate, liquidity and capital (credit) risks. Then, a capital plan can be created related to the stress event to assess whether capital is sufficient to sustain normal operations even under adverse conditions. The goal of the exercise is to help identify risks, assess vulnerabilities, design mitigation strategies and establish a realistic capital contingency plan.

2023 stress test

The 2023 stress test factors highlight the current economic conditions of high inflation, high interest rates, deposit volatility and recession risk. This year’s DFAST is unique in that the scenarios were presented at the onset of the current commercial banking crisis. In the Fed’s prescribed Severely Adverse scenario, rates drop to near zero, GDP growth aggressively contracts, the unemployment rate rises to 10%, and home prices drop.

If, in performing the DFAST Stress Test, a credit union’s capital ratio recedes below the assigned threshold over the horizon, a capital plan must be put in place to identify the source for replacing depleted capital. Mitigation strategies within the capital plan could include adjusting asset/liability mix, reducing expenses, executing asset sales, or considering secondary capital or deleveraging. The following graphs depict a projection of four of the primary factors, comparing the Base scenario to the Severely Adverse scenario.

Crossing the $10B threshold

If your credit union is at or approaching $10 billion in assets, take the opportunity to understand expectations that accompany your institution’s growth. A strong ALM solution uses components, such as credit loss models, interest rate and liquidity risk, capital budget planning, etc., to produce a dynamic projection of your balance sheet, income and capital, based on stress scenarios.

Contact Catalyst Strategic Solutions’ ALM Service today to schedule a time to discuss your options for an integrated DFAST solution.