By Mark DeBree, CFA, Catalyst Strategic Solutions Managing Principal

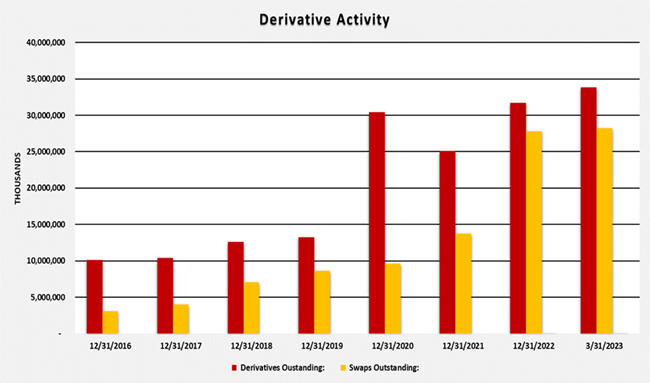

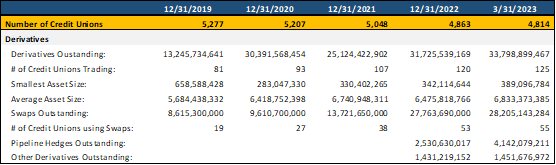

Catalyst has seen a sharp uptick in derivative trading activity through the first half of 2023, and it appears more than just Catalyst clients are increasing their trading activity. Since the end of 2019, total derivatives outstanding have increased from $13.2 billion to almost $34 billion as of March 31, 2023.

As shown in the tables below, the vast majority (> 80%) of these derivative transactions have been in interest rate swaps, while the bulk of the remaining amounts have been used to support pipeline hedging activities.

Why are we seeing this trend in the industry?

Not just for the big credit unions

Interest rate derivatives are an extremely effective tool, available to all financial institutions, to help them manage interest rate risk exposures. Traditionally, these instruments were employed by the larger financial institutions, but it’s much more common now for smaller credit unions to use interest rate derivatives. At the end of 2019, the smallest credit union to have interest rate derivatives on their balance sheet was $659 million, but in 2020, we saw derivative use extend to credit unions with assets below $300 million. Similarly, the average asset size of credit unions using interest rate derivatives increased to almost $7 billion at the close of the first quarter in 2023.

The takeaway from these trends is not the average asset size or even the smallest asset size, but rather that credit unions of all shapes and sizes have been turning towards the derivatives market to support their risk management practices. Catalyst is seeing the same trends within its client base, as well. This is good news for the credit union industry.

What risks are credit unions looking to hedge?

Within the Catalyst client base, there is no single hedging strategy that credit unions have been pursuing, but they can be boiled down into two main viewpoints, coinciding with the balance sheet compositions of each credit union:

- Credit unions with large and growing mortgage portfolios

- Credit unions with shorter asset maturities structures combined with significant growth in high-rate term deposits

For the first cohort, these credit unions need risk capacity to continue to originate and portfolio more real estate loans, given current mortgage rates. The swap strategies they are pursuing are enabling them to mitigate the interest rate risk these mortgages add to the balance sheet by synthetically converting a portion of their fixed rate mortgage loans into adjustable-rate assets. This provides additional risk capacity for these credit unions to continuing growing real estate loans.

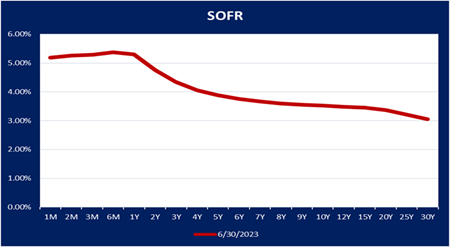

Another benefit of this strategy right now is offered by the overall shape of the yield curves. When you hedge real estate assets, you enter into a pay fixed/receive floating rate swap, which enables credit unions executing this strategy to be a net receiver of interest payments over the initial terms of the transaction. Some credit unions desire the short-term potential boost to income over the near-term.

curves. When you hedge real estate assets, you enter into a pay fixed/receive floating rate swap, which enables credit unions executing this strategy to be a net receiver of interest payments over the initial terms of the transaction. Some credit unions desire the short-term potential boost to income over the near-term.

The second group addresses credit unions that have relatively short asset maturity structures (i.e., auto loans) but have seen strong growth in high-rate member term certificates (non-member deposits). These credit unions are concerned that when the economy turns, their asset yields will fall when interest rates decline (as the autos roll over into lower yielding loans), but the term certificates remain at elevated interest rates, materially hurting their earnings profile.

These credit unions are entering into an opposite interest rate derivative structure where they pay floating and receive fixed rates. This hedge is typically applied against the high-rate term certificates, synthetically converting these deposits into adjustable-rate deposits. The goal of this strategy is to ensure that cost of funds declines when market interest rates decline to alleviate margin compression when asset yields decline along with falling market rates.

Why interest rate derivatives?

Interest rate derivatives offer certain advantages over other products that also manage interest rate risk exposures. One of the most common alternatives is the use of borrowings. Interest rate derivatives tend to be more advantageous to borrowings for two primary reasons:

- The fixed rate side of an interest rate swap is typically lower than FHLB alternatives.

- Using interest rate swaps do not consume secondary liquidity, as the use of borrowings would.

In our current market, we have extremely high composition for deposits, low liquidity and uncertainty in the overall economic direction. Any of those three challenges create liquidity pressures at credit unions, but the presence of all three at the same time requires great prudence in liquidity management practices.

Interested in derivatives?

Catalyst guides credit unions toward the solution that offers the lowest possible cost to achieve their goals, while preserving liquidity sources. Interest rate derivatives can be that tool when it comes to interest rate risk management.

To speak with an expert about how interest rate derivatives could help your credit union manage risk, contact Catalyst today.