By Christopher Uhl, Catalyst Strategic Solutions Senior ALM Consultant

When liquidity tightens, credit unions begin hearing recommendations to perform a core deposit study or deposit analysis, but executives may wonder how much value they add. Value derived from a core deposit study is directly proportional to the way your credit union manages the balance sheet.

If you “actively” position your balance sheet (in terms of targeted NEV exposure) based on phases of the interest rate cycle, a core deposit study could provide significant value. On the other hand, if you “passively” position your balance sheet – accepting the risk added to your balance sheet based on member deposit, loan and investment flows – a core deposit study may not drive as much tangible value.

Both balance sheet management styles are widely employed throughout the credit union industry, but the “active” style requires a higher level of accuracy in its risk management practices. The reason accuracy is important lies in how decisions are made.

For example, the present economy has high interest rates, moderating inflation and warning signs of an upcoming recession. These factors suggest interest rates will fall over the upcoming months or year. As an “active” balance sheet manager, this scenario highlights the need to push your targeted NEV exposures closer to, but not past, your policy limits to capture as many long-term, higher-rate assets as possible.

Of course, knowing a credit union’s true risk capacity is necessary to make the most informed decisions. This is where a core deposit study offers credit union management its most significant value: improving the underlying risk measurement process.

Let’s examine how deposit studies improve risk management and earnings

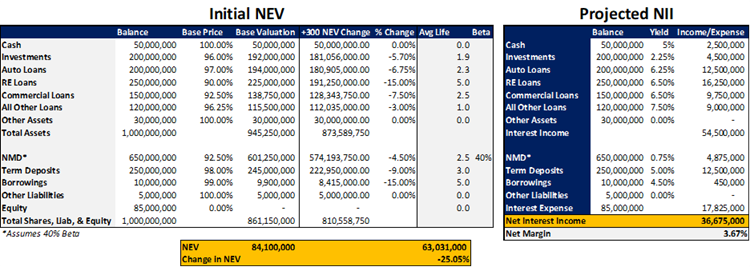

In the below example, assume a $1 billion credit union targets a -25% NEV exposure in a +300bps shock. Based on their targeted risk level and balance sheet composition, they generate net interest income of $36.7 million, which is a net margin of 3.67%.

Embedded within this credit union’s ALM assumptions is a 2.5 year weighted average life for non-maturity deposits; this is close to typical default assumptions applied by many credit unions nationally.

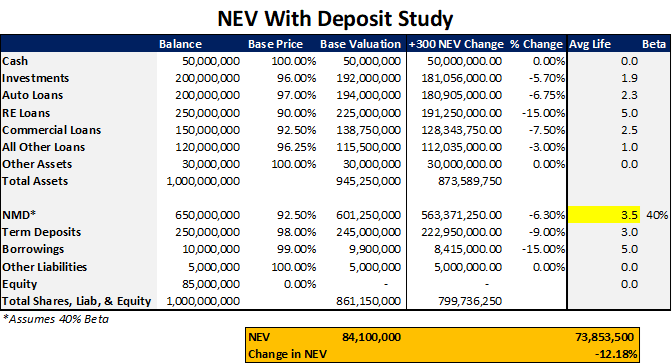

However, let’s assume the credit union performs a deposit study and determines the true weighted average life is 3.5 years rather than the assumed average life of 2.5 years.

Armed with this information, the credit union updates their ALM model and determines their actual NEV exposure is -12.18%, much lower than the previously estimated -25.0%.

At this junction, a difference emerges between active and passive balance sheet management styles. The passive manager performs a core deposit study, applies the results and produces a lower overall interest rate risk exposure. This may make their board and examiners happy, but it does not add value to the credit union’s bottom line unless something is done with this information. In fact, we often hear that the deposit study is closer to an additional cost than an increased value to the credit union.

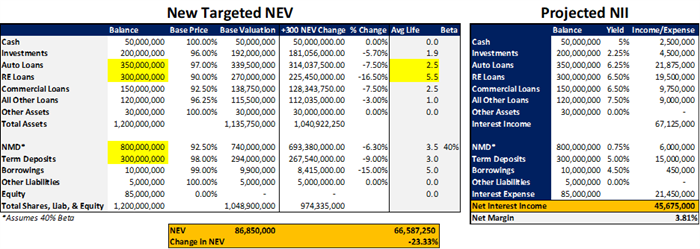

The active management style, on the other hand, identifies additional risk capacity available at the credit union. Recalling the current economic environment, deposits and loans can be increased to add risk to the balance sheet to return the NEV exposure closer to the desired -25% target.

As illustrated below, the active manager can add $200 million in deposits and $200 million in new loans and achieve a +300 NEV volatility of -23.33%, much closer to the target. The value of the deposit study to the credit union shows up in net interest income via additional growth and risk-taking capacity. In this example, net interest income increases $9 million to $45.7 million due to the incorporation of the core deposit study.

The silver lining in deposit studies

The likelihood is high that you have been or will be asked to perform a deposit study. Try not to view this request as an obstacle or a requirement for regulatory compliance. Rather, this is an opportunity to refine your risk management practices and take a more proactive approach to balance sheet management. This will enable you to drive additional value to your bottom line.

As credit unions grow larger, the risk management process becomes more integral to the overall decision-making process. There is a shift from viewing risk as a barometer of what has been done over the past month or quarter to viewing how much risk can be added over the next month or quarter to achieve a desired risk exposure. This change in philosophy not only helps credit unions understand members and deposit flows better but also helps improve overall earnings profiles.

It’s difficult to eliminate all risk exposure, but we can use tools to more accurately predict risk. Growth and increased complexity of the balance sheet will dictate a closer look at our risk management practices. More refined modeling assumptions may be necessary to better support credit union management philosophies.

Catalyst Strategic Solutions has been supporting credit unions with industry leading solutions and methods in deposit analytics for over a decade. Let our data driven approach help drive more bottom-line value to your credit union too.