Almost 30% of financial institutions indicated an increase in check fraud since 2020, according to a survey facilitated by Advanced Fraud Solutions (AFS).

Although the quantity of checks circulating has decreased, the dollar value of checks circulating has increased. That means checks in circulation are still a ripe target for fraudsters. So, how can credit unions mitigate this risk?

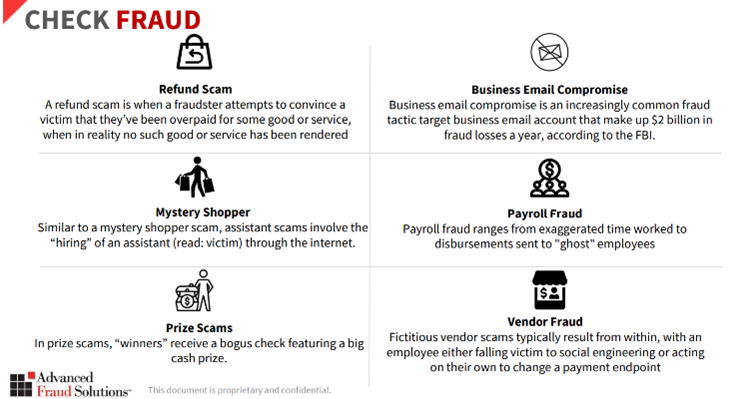

Common tactics for check fraud

To mitigate risk, credit unions can start by knowing where to look and what types of check fraud are most prevalent. AFS reports that consumers who have been affected by the economic downturn tend to be targets for fraudsters in refund scams, mystery shopper scams and prize scams. For credit unions, adding new employees or laying off employees can be areas of vulnerability. Common fraud tactics in this arena include payroll fraud, business email compromise and vendor fraud.

Check fraud is an omnichannel threat

To consider how check fraud poses a threat for a credit union, review all the channels where a fraudster can intervene. These include front-office access (tellers), ATM/ITMs, mobile deposits and batch or back-office deposits. Multiple deposit channels provide convenience for members but make it difficult to spot fraudsters’ entry points. Having an omnichannel solution in place that assesses potential threats is essential for effective check fraud mitigation.

Fight fraud by preventing it

Catalyst Corporate offers credit unions a premium check fraud detection solution with its AFS TrueChecks® Service. AFS estimates that TrueChecks captures 60-70% of fraudulent deposits. This user-friendly solution provides an inclusive database, software flexibility and efficient processing. TrueChecks employs a comprehensive, national database of counterfeit checks and risky accounts that is referenced regardless of deposit channel utilized.

“Checks are a ripe target for fraudsters because they get more bang for their buck. The best way to fight fraud is to prevent it,” AFS VP of Strategic Partnerships Jordan Bothwell explains.

The TrueChecks solution is integrated with Catalyst Corporate’s TranzCapture™ suite of deposit services, as well as ImageClear deposit service, where it performs real-time check verification across all deposit channels. On-demand check risk evaluation is also available via direct access to the TrueChecks web-based portal through Catalyst Corporate. Even credit unions that do not use Catalyst deposit processing services can take advantage of this solution.

AFS offers cohesive, single-source protection for all aspects of the deposit fraud journey. Mitigate risk at your credit union with Catalyst Corporate’s premium check fraud detection solution, AFS TrueChecks. Contact us for more information.