by

Catalyst Corporate | Sep 30, 2022

It was the best of times; it was the worst of times. That may be a famous line from a Charles Dickens novel, but it is also how CUNA Mutual Group Chief Economist Steve Rick summarized his forecast on the economy for credit union attendees at Catalyst Corporate’s recent 2022 Economic & Payments Forum.

“The key is that every economy wants to be at equilibrium,” Rick said, referring to the volatility created by the country’s high inflation and low unemployment. “It’s just like your body wanting to be at 98.6 degrees. The economy, as it returns to equilibrium, will affect credit unions in many ways.”

Steve Rick defined the best and worst of times in the current economy and provided key takeaways for credit unions.

The economy is not in a recession

Although the nation has had two consecutive quarters of negative growth, Rick strongly refuted any notion of an economic recession. A recession, as defined by the National Bureau of Economic Research, does include two quarters of negative growth, he said, but there are other factors to consider.

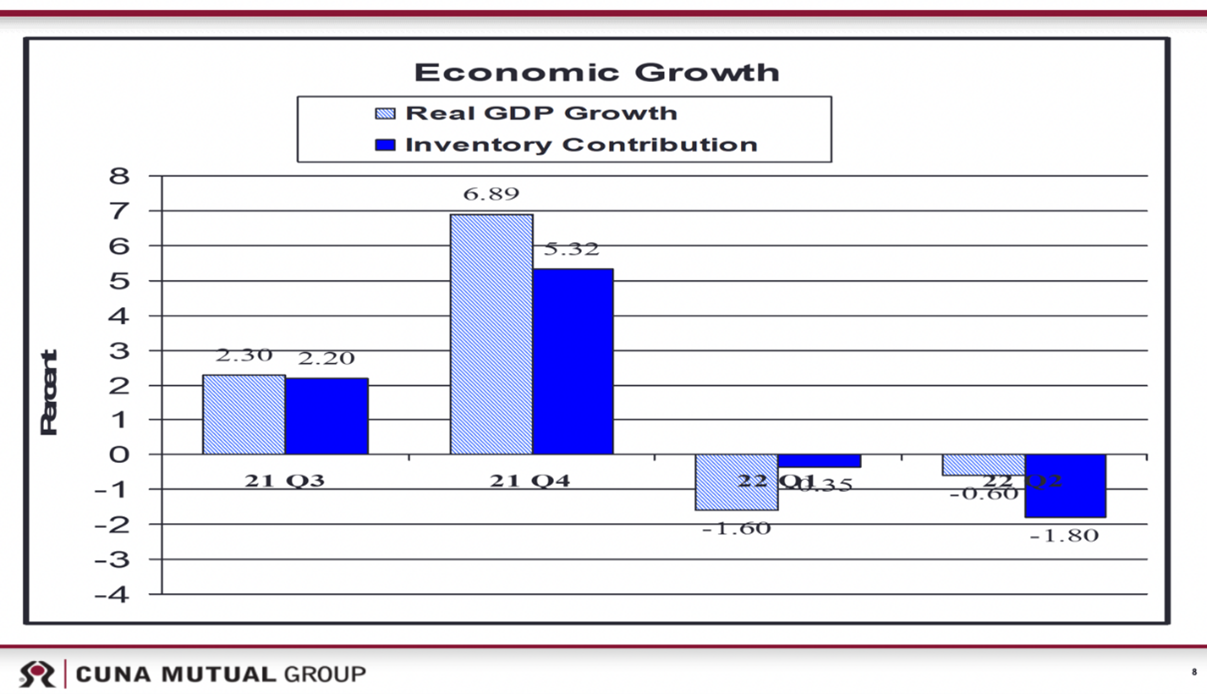

Job and income growth need to be negative to indicate economic recession, but both are very strong now, Rick said. To pinpoint this negative growth trend, Rick looks to inventories.

Companies are still adding to their inventory, but they are doing it at a slower pace, as Rick’s chart shows:

The economy is still growing, Rick said. “If you want to use the word recession again, call it an inventory recession, but not a sales recession.”

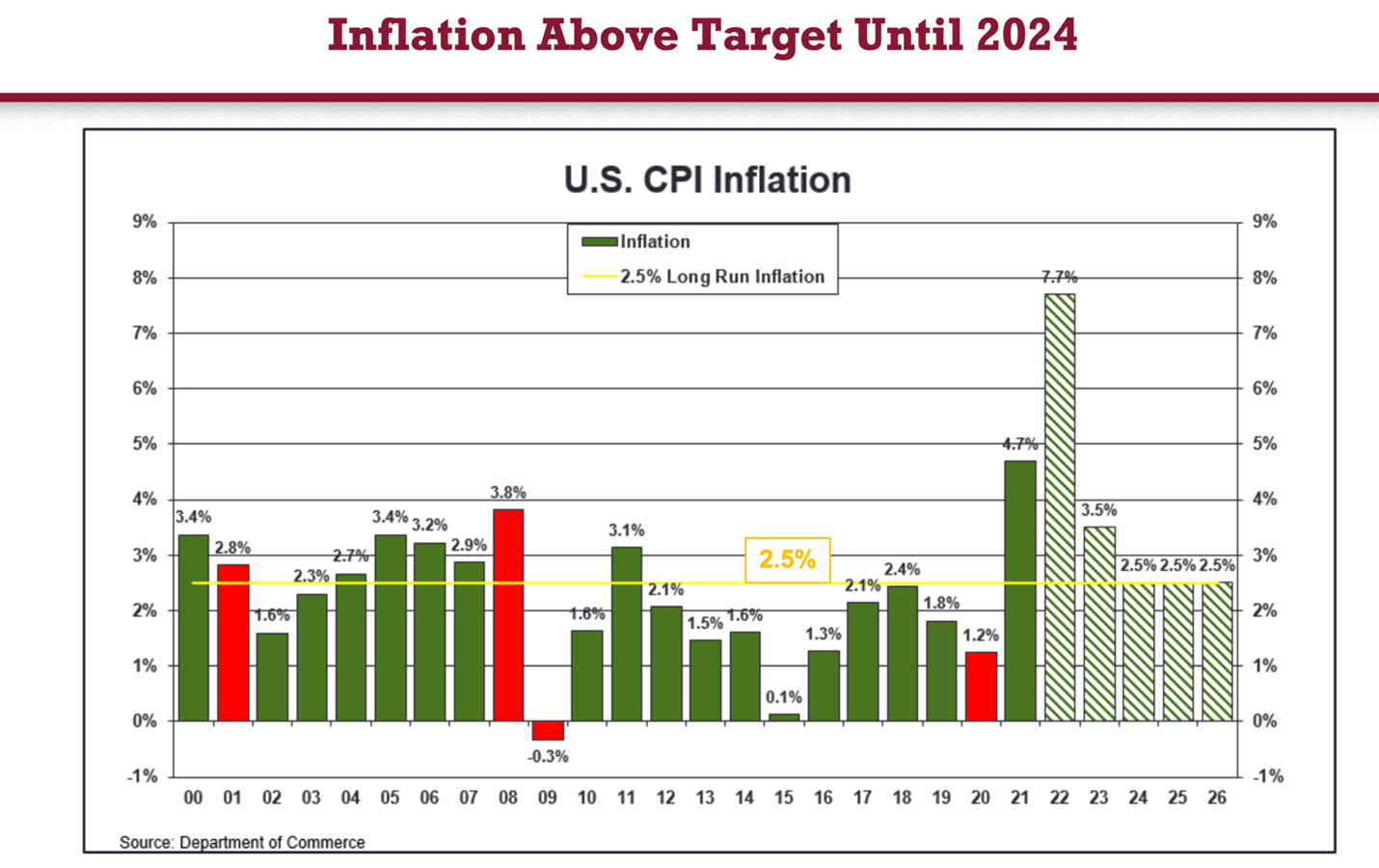

Inflation hit a 40 year high

This is the worst of times.

Inflation in our economy is supposed to sit around 2-2.5%, according to Rick, but it shot to 8-9% this last year. “This creates potential problems moving forward. One thing we want to focus on is wage increases. If wages increase at a rate that meets inflation, inflation will continue to rise. So far, we aren’t seeing that,” but it is something the Fed is keeping an eye on.

Inflation, at its core, is just “too many dollars chasing too few goods,” he said. “We’re seeing people spend a lot right now, and credit union deposits are beginning to decrease from their inflated levels. The ‘too few goods’ part refers to the lower supply we’re seeing in the market currently.”

As spending begins to decrease, Rick said, supply should return to normal levels in the coming years, slowing inflation. If wages don’t rise, most economists predict inflation will return to equilibrium in the next few years.

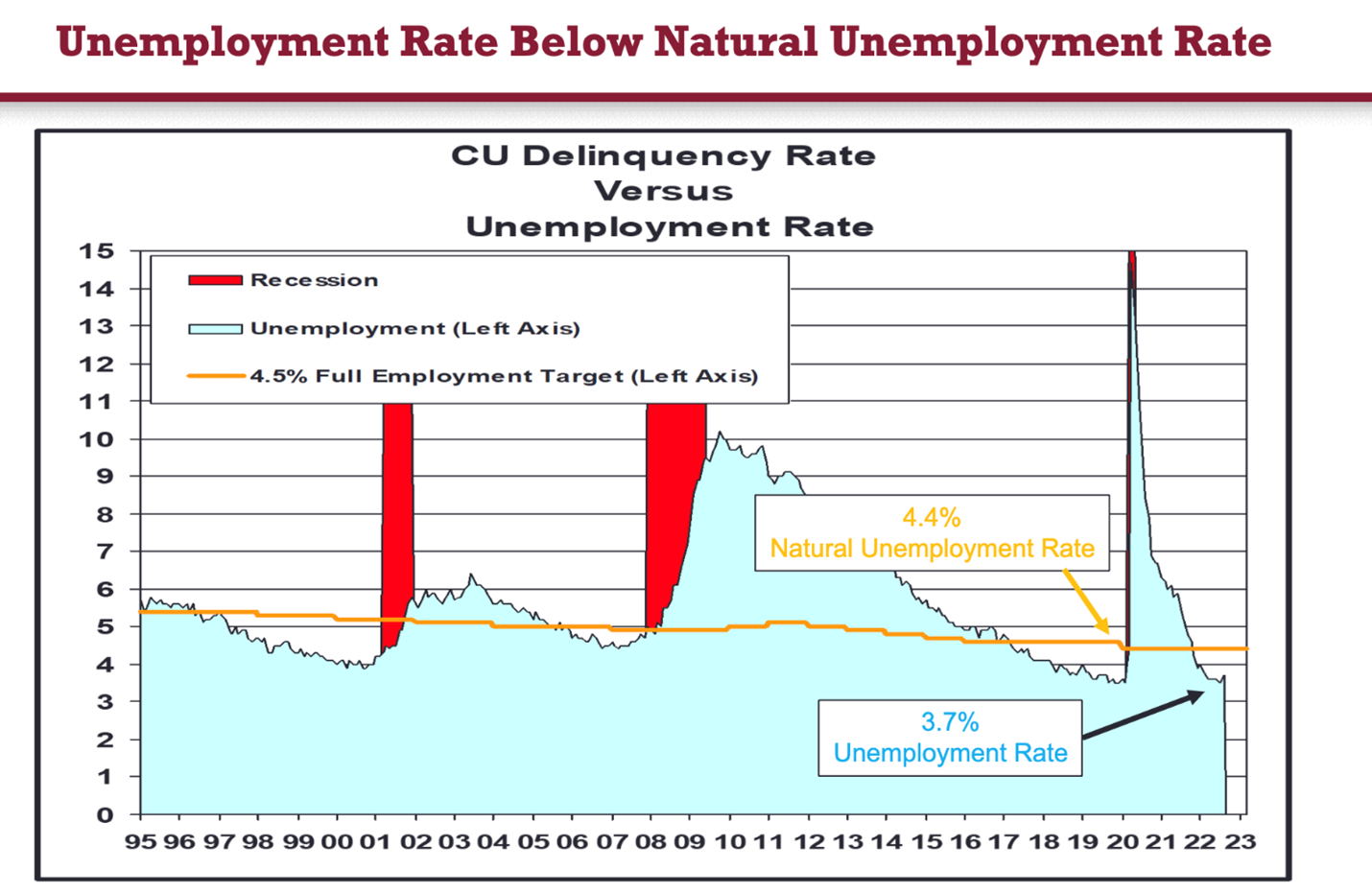

The labor market is booming

This is the best of times.

Current U.S. job openings number approximately 11 million, the highest level seen in this country. Labor supply, on the other hand, is only around five million.

Supply is slowly rising as people begin to return to the labor market, he said, while job openings are beginning to slowly decrease. That gap is closing.

For credit unions, delinquency rates are the lowest ever, due to the best of times in the labor market. For the most part, those who want a job have a job, and deposits are high right now, which pushes delinquency ratings lower.

7 key takeaways for your credit union

- The labor shortage will likely continue for two more years.

- Employees have the bargaining power now.

- Labor turnover is high.

- New labor training and wage costs are high.

- Labor productivity will be lower due to high turnover.

- Bankruptcy filings will hit a record low.

- The labor force participation rate will return to equilibrium in two years.

Steve Rick’s Economic Forecasts for Credit Unions presentation was packed with valuable insight. In case you missed it, you can still access his session on-demand via ON24.