2018 was another stellar year for the credit union industry. According to the Credit Union National Association (CUNA), through September 2018, asset yields are up 19 basis points and funding costs are up only eight basis points over year-end 2017. Net interest margin has risen steadily for several years, reaching a high of 310 basis points through September. And, industry return on assets (ROA) was 96 basis points in September, up from 77 basis points for 2017.

While credit unions are doing well overall, some are facing challenges. Credit unions with assets below $50 million show a decline in total membership. The industry’s high return on assets (ROA) of 96 basis points is buoyed by credit unions with $1 billion or more in assets, with an average ROA of 108 basis points. Every asset class below $1 billion has an average ROA below 96 basis points. In fact, as asset size declines, credit union ROA generally does, too.

For years, the National Credit Union Administration (NCUA) has emphasized preparing for a potential liquidity crunch. In addition to focusing on analytics of near- and intermediate-term cash flows, credit unions have been encouraged to track their polices and key performance measurements.

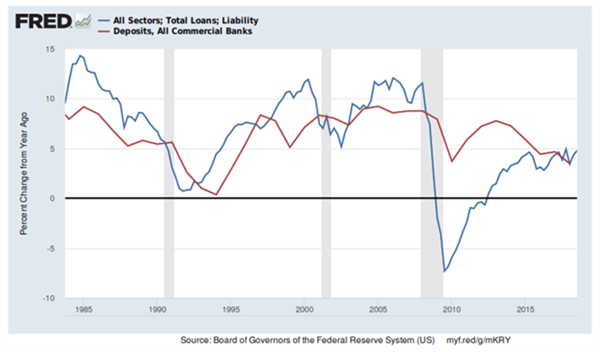

Heading into 2019, a key concern for many credit union balance sheets is maintaining liquidity. Loan growth continues to decrease, hitting 9.3 percent for 2018, down from 10 percent in 2017 and 10.6 percent in 2016. Even so, loan growth has significantly outpaced deposit growth. This relationship mismatch is often used as a marker for predicting recessions.

The NCUA continues to underscore the importance of credit union access to alternative funding. This means ensuring prudent strategies are in place for managing alternative funding sources and for recomposing the credit union balance sheet, if necessary. Catalyst Strategic Solutions' ALM Service works with credit unions to devise appropriate balance sheet strategies.

Credit unions should be particularly mindful of the auto finance sector. Credit union market share in auto financing has been growing the past couple of years. According to Experian, the new auto rate for prime paper is up 57 basis points year-over-year, and the used auto rate is up 52 basis points. That’s great news!

Some credit unions, however, may be buying market share with below-market auto lending rates. Although credit union philosophy advocates providing value to members, including below-market rates, some credit unions are booking loans with non-members, and at rates well below what could be achieved by buying Treasury or agency bonds. With liquidity a key concern, there is a strong case for the investment alternative.

For several years, the NCUA has placed great emphasis on liquidity management. 2019 may be the year that illuminates the gap between those who effectively plan and manage their liquidity positions and those who do not, potentially subjecting their institutions to greater regulatory scrutiny.