By Lorena Paredes, Manager – Loan Participation & Credit

Unsecured loan portfolios typically consist of higher-yielding assets due to the credit risk associated with the loans. With loan demand down and cash deposits up, buyer demand for unsecured loan participations has increased over the past year, and many credit unions are broadening their loan participation policies to include unsecured loans. Although a great option for higher-yielding assets, it’s important to analyze the associated credit risk factors, which include: loan origination source, membership requirements, underwriting guidelines, note provisions, credit protection insurance, projected loan losses and servicing.

Before diving into a risk assessment of unsecured loans, examine the key differences between direct and indirect unsecured loans and how they’re handled.

Direct vs. indirect unsecured loans

Direct unsecured loans are granted by a credit union to its members. Direct loan borrowers are likely to have a strong member relationship with credit union staff and, therefore, usually maintain a satisfactory status. To partially mitigate unsecured credit risk, some credit unions offer preferred rates to members with payroll direct deposits and/or automatic payment transfers from the borrower’s credit union account. Additionally, promissory notes generally include a security provision securing the loan on the member’s credit union shares, deposits and other forms of collateral. Offering credit protection insurance is another way to help reduce credit risk, while also increasing fee income and providing protection for the borrower in a financial hardship.

For indirect loans, NCUA loan participation regulations require the borrower to become a member of one of the participating credit unions before the federally insured purchasing credit union acquires a participation interest in the loan. In most cases, the loan originator will complete a new membership account form when funding the loan. As a result, indirect borrowers are likely to have a limited relationship with the credit union. Additionally, the loans may have been originated at lower interest rates to compete with other lenders, and have higher – sometimes borrower-paid – loan origination costs. Similarly, indirect loan borrowers may also be offered rate discounts in exchange for monthly electronic payment transfers from a credit union or other financial institution account. While this automatic payment partly mitigates credit risk, the borrower is likely to set up payments at the other financial institution, making it less likely the borrower communicates with the lender in the early stages of a financial hardship.

Unsecured loans are generally underwritten based on more conservative guidelines than auto loans or other secured loans. Higher credit limits and lower interest rates are typically reserved for borrowers with the best credit scores and strongest profiles. That said, indirect lending may be more competitive, and higher credit limits may also be extended to sub-prime borrowers. For these reasons, the credit union seller should establish and approve loans according to their own guidelines. Exceptions to policies should also be approved by the credit union, rather than the originator.

Risk analysis

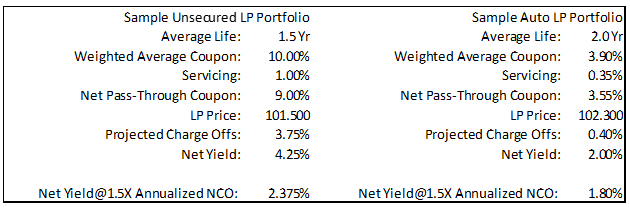

When analyzing loan participation purchase price and yield to the buyer, projected loan losses and repayments should be evaluated by reviewing the credit union’s loan program performance history – a minimum of two years of charge-offs and defaults is recommended. The net yield, net of purchase premium and projected losses, should cover the credit risk associated with the loan profile. For more conservative credit unions, analyzing the net yield at 1-1/2 or two times the projected losses is also recommended. The table below depicts sample unsecured and auto portfolios. The unsecured net yield of 4.25 percent is very attractive in the current market; however, the net yield is significantly impacted by a 50 percent increase in the projected losses. The net yield impact for an auto loan portfolio is minimal on a traditional auto-secured portfolio. The credit union should determine if the net yield is adequate compensation for the investment’s liquidity, optionality, structure, and credit risk, compared to other investment options.

The servicing requirements and cost for unsecured loans may be higher than auto, mortgage, or other secured loans. It is important to have strong servicing policies and procedures, as communicating with the borrower in the early stages of default may present the credit union an opportunity to offer other loan products or services that can help a member prevent default. Skipping a payment may help resolve a short-term, temporary financial need. Modifying the loan to affordable terms for the borrower may help reduce or prevent a loss.

As with any loan participation purchase, comprehensive due diligence on the loan originator/seller and servicer is essential. This should be completed by analyzing the loan profile, seller as the loan originator, seller as the servicer throughout the life of the loans, underwriting guidelines and procedures, collection and servicing guidelines and procedures, loan program performance history, loan files and the loan participation agreement. The loan participation agreement should also detail the servicer’s rights and responsibilities.

With sound due diligence, unsecure loans can serve as a viable opportunity to add higher-earning assets to your balance sheet. Catalyst Corporate’s Loan Participation Program, LPX, has facilitated more than $3 billion in credit union loans since 2014. Our experts are here to help with insight and experience you can trust. For sample due diligence procedures, loan file review checklists or additional information, contact us today.